Talking about end-of-life planning is never easy. Many families avoid the conversation until it’s too late—often leaving loved ones overwhelmed with emotional grief and unexpected financial stress. That’s where Final Expense Insurance quietly makes a powerful difference.

Below are real-life inspired stories that show how Final Expense Insurance helped families during one of the most difficult moments of their lives—and why planning ahead truly matters.

A Mother’s Final Gift of Peace

When Linda, a 72-year-old grandmother, passed away unexpectedly, her daughter Maria was devastated. Along with grief came a new worry: funeral costs.

Linda had always lived on a fixed income, but she had taken out a modest Final Expense Insurance policy years earlier to protect her family from financial hardship.

When the time came:

-

The Final Expense Insurance policy paid out quickly

-

Funeral and burial expenses were fully covered

-

Maria didn’t have to take out loans or start a fundraiser

“My mom couldn’t protect us from the pain,” Maria said, “but she protected us from the stress.”

That small Final Expense Insurance policy turned into Linda’s final act of love.

A Spouse Protected From Financial Shock

After 40 years of marriage, Robert lost his wife, Elaine. They had no large savings, and Robert worried about affording a proper service while coping with his loss.

Unknown to Robert, Elaine had quietly purchased Final Expense Insurance years earlier. She never mentioned it—she wanted it to be a surprise safety net when it was needed most.

The result was immediate relief:

-

No financial panic during an already painful time

-

No rushed decisions about funeral arrangements

-

No debt added to grief

When the policy paid out, Robert was able to focus on honoring Elaine’s life instead of worrying about money.

“Final Expense Insurance gave me peace when I felt completely overwhelmed,” Robert later shared. “I could focus on remembering her, not paying bills.”

Helping Adult Children During a Hard Goodbye

James was a single father who raised three children on his own. As he neared retirement, he purchased Final Expense Insurance to make sure his children would never feel financially burdened during an already painful time.

When he passed away, his Final Expense Insurance policy made a meaningful difference:

-

His children didn’t argue over funeral costs

-

Expenses were paid directly through the Final Expense Insurance policy

-

They were able to plan a meaningful memorial that truly honored his life

Because of Final Expense Insurance, the family had the time and emotional space to grieve together—without added financial tension or stress.

You can explore and compare reliable Final Expense Insurance Provider options at https://quotemaestro.com/ to find coverage that fits your needs and budget

Why These Stories Matter

These families had different backgrounds, incomes, and situations—but one thing in common: planning ahead with Final Expense Insurance changed everything.

Final Expense Insurance helped by:

-

Covering funeral, burial, and memorial costs

-

Providing fast payouts when families needed financial support the most

-

Preventing debt, loans, or added emotional strain during a time of loss

Final Expense Insurance isn’t just insurance—it’s peace of mind for the people you love.

You can explore and compare reliable Final Expense Insurance Provider options at https://quotemaestro.com/ to find coverage that fits your needs and budget.

Who Should Consider Final Expense Insurance?

Final Expense Insurance is often ideal for:

-

Seniors on fixed incomes who want affordable, predictable coverage

-

People without large savings or traditional life insurance who still want to cover funeral and burial costs

-

Anyone who wants to ease the financial and emotional burden on loved ones during a difficult time

Because Final Expense Insurance typically offers simplified approval, many policies are easy to qualify for and remain active for life as long as premiums are paid.

You can explore and compare reliable Final Expense Insurance Provider options at https://quotemaestro.com/ to find coverage that fits your needs and budget.

A Small Policy With a Big Impact

The most powerful thing about final expense insurance isn’t the money—it’s what it prevents.

No rushed fundraising

No family arguments

No guilt about unpaid expenses

Just dignity, planning, and love.

You can explore and compare reliable Final Expense Insurance Provider options at https://quotemaestro.com/ to find coverage that fits your needs and budget.

Frequently Asked Questions (FAQs)

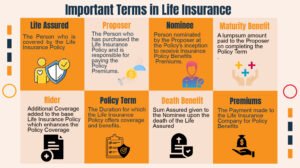

What is final expense insurance?

Final expense insurance is a type of whole life insurance designed to cover funeral, burial, and other end-of-life costs.

How quickly do families receive the payout?

In most cases, beneficiaries receive the payout within days or weeks after filing a claim, allowing them to cover expenses quickly.

Can final expense insurance be used for anything?

Yes. While typically used for funeral costs, families can use the funds for medical bills, debts, or other final expenses.

Is final expense insurance expensive?

Premiums are usually affordable and fixed for life, making it accessible for seniors and those on a budget.

Who receives the money?

The beneficiary you choose—usually a family member—receives the payout directly.

Is medical approval required?

Many policies offer simplified or guaranteed approval, meaning little to no medical exam is required.