Planning for the inevitable can be stressful, especially when deciding how to cover funeral and burial costs. Two popular options are Final Expense Insurance vs. Prepaid Funeral Plan. Understanding how each works is essential to making a choice that best suits your financial situation and your family’s needs.

What Is Final Expense Insurance?

Final expense insurance is a type of whole life insurance designed to pay for funeral, burial, and other end-of-life costs.

Key Features:

-

Affordable premiums, often fixed for life

-

Simplified or guaranteed approval, even for seniors

-

Funds are paid directly to your beneficiary

-

Flexible use: funds can cover funeral, medical bills, or other final expenses

Because the money goes to your beneficiary, they have flexibility in how it’s used. Seniors on a fixed income often choose final expense insurance for its affordability and ease of planning.

You can explore and compare policies at QuoteMaestro.

What Is a Prepaid Funeral Plan?

A prepaid funeral plan is a contract with a funeral home where you pay in advance for your funeral services.

Key Features:

-

Locks in today’s prices for funeral services

-

Covers specific services you select (casket, burial, ceremony, etc.)

-

Payment is usually made directly to the funeral home

-

Limited flexibility: funds are used only for the selected services

While prepaid funeral plans can protect against rising costs, they may restrict your family’s choices if plans change over time.

Final Expense Insurance vs. Prepaid Funeral Plan: Key Differences

| Feature | Final Expense Insurance | Prepaid Funeral Plan |

|---|---|---|

| Payment Type | Monthly premiums or one-time payment | Lump-sum payment upfront |

| Beneficiary Flexibility | Beneficiary can use funds as needed | Funds only for pre-selected funeral services |

| Approval | Simplified or guaranteed | Requires contract with funeral home |

| Cost Protection | Covers rising costs indirectly | Locks in today’s prices |

| Ease of Use for Family | Beneficiary receives funds to handle arrangements | Funeral home manages arrangements directly |

Pros and Cons

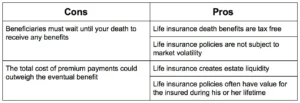

Final Expense Insurance

Pros:

-

Flexible use of funds

-

Easy for seniors to qualify

-

Can cover unexpected additional expenses

Cons:

-

Amount may be limited based on premiums

-

Funds may not directly go to funeral home unless specified

Prepaid Funeral Plan

Pros:

-

Locks in prices and services

-

Guarantees funeral arrangements will be handled

Cons:

-

Less flexibility if your wishes or family situation change

-

Only covers selected services, additional costs may still arise

Which Option Is Right for You?

The choice between Final Expense Insurance vs. Prepaid Funeral Plan depends on your priorities:

-

Choose final expense insurance if you want flexibility, affordable monthly payments, and the ability to leave money to your loved ones.

-

Choose a prepaid funeral plan if you want to lock in services at today’s price and have the funeral home manage everything.

Many families use a combination of both to ensure costs are covered and preferences are met. Compare options and find plans tailored to your needs at QuoteMaestro.

Frequently Asked Questions (FAQs)

1. What is the main difference between final expense insurance and a prepaid funeral plan?

Final expense insurance provides funds to a beneficiary to cover end-of-life costs, while a prepaid funeral plan locks in specific services and payment directly with a funeral home.

2. Which option is more flexible?

Final expense insurance is more flexible because the funds can be used for funeral, medical bills, or other expenses. Prepaid plans are limited to preselected services.

3. Can seniors on a fixed income afford final expense insurance?

Yes. Many policies are specifically designed for seniors on a fixed income with predictable, manageable monthly premiums.

4. Can I combine both options?

Yes. Some families choose Final Expense Insurance vs. Prepaid Funeral Plan together to ensure both financial flexibility and guaranteed funeral arrangements.

5. Where can I compare plans?

You can compare policies and prepaid funeral options safely and easily at QuoteMaestro.

Final Thoughts

Both final expense insurance and prepaid funeral plans provide peace of mind for seniors and their families. Understanding the differences ensures you select the option that fits your needs, financial situation, and personal preferences.

For seniors on a fixed income, Final Expense Insurance vs. Prepaid Funeral Plan comparison is essential to make the most informed decision. Use QuoteMaestro to compare options and find the right solution today.