Shopping for health insurance can feel overwhelming. Dozens of plans, confusing terms, and wildly different prices can make it hard to know what you’re actually comparing. But learning how to compare health insurance quotes the right way can save you money, prevent coverage gaps, and help you choose a plan that truly fits your needs.

Whether you’re buying coverage for the first time or switching plans, this guide will show you how to compare health insurance quotes like a pro—without the stress.

Why Comparing Health Insurance Quotes Matters

Many people focus only on the monthly premium. While price matters, it’s only one part of the picture. Two plans with similar premiums can have very different costs once you actually use your insurance.

Comparing health insurance quotes properly helps you:

-

Avoid surprise medical bills

-

Find better coverage for the same price

-

Understand what you’re paying for

-

Choose a plan that matches your healthcare needs

A little comparison now can prevent big expenses later.

Step 1: Understand What Each Health Insurance Quote Includes

Before comparing prices, make sure you’re comparing the same type of coverage. Every health insurance quote includes several key elements.

Key Terms to Look At

-

Monthly premium: What you pay each month

-

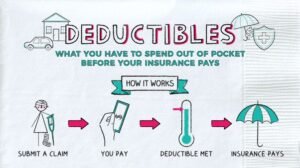

Deductible: What you pay before insurance starts covering costs

-

Copayments and coinsurance: Your share of costs after the deductible

-

Out-of-pocket maximum: The most you’ll pay in a year

Looking at all of these together gives you the true cost of a plan—not just the sticker price.

Step 2: Compare Coverage, Not Just Price

Low premiums can be tempting, but they often come with higher deductibles and out-of-pocket costs. When learning how to compare health insurance quotes, coverage matters just as much as cost.

What to Check in Each Plan

-

Preventive care coverage

-

Prescription drug benefits

-

Mental health services

-

Maternity and emergency care

Make sure the plan covers the services you actually use—or may need in the future.

Step 3: Check Provider Networks Carefully

A plan may look great on paper, but if your doctor isn’t in-network, costs can rise quickly.

Before choosing a plan:

-

Confirm your primary doctor is in-network

-

Check specialist access

-

Review hospital and urgent care coverage

This step is especially important if you have ongoing medical needs.

Step 4: Consider Your Lifestyle and Health Needs

Comparing health insurance quotes isn’t one-size-fits-all. The best plan for someone else may not be right for you.

Think about:

-

How often you visit the doctor

-

Whether you take regular prescriptions

-

Your travel or relocation plans

-

Family coverage needs

Matching coverage to your lifestyle helps avoid overpaying or underinsuring.

Step 5: Use a Trusted Comparison Platform

Trying to compare plans manually can be time-consuming and confusing. Using a trusted comparison tool makes the process faster and clearer.

Platforms like https://quotemaestro.com/ allow you to:

-

Compare multiple health insurance quotes in one place

-

Review coverage details side by side

-

Find plans that fit your budget and needs

This approach saves time and helps you make confident decisions.

Common Mistakes to Avoid When Comparing Quotes

Even experienced shoppers make mistakes. Avoid these common pitfalls:

-

Choosing the lowest premium without reviewing coverage

-

Ignoring the out-of-pocket maximum

-

Overlooking prescription coverage

-

Missing enrollment deadlines

Knowing how to compare health insurance quotes properly helps you avoid costly errors.

Final Thoughts: Compare Smarter, Not Harder

Learning how to compare health insurance quotes like a pro gives you control over your healthcare decisions. By looking beyond price, understanding coverage details, and using reliable comparison tools, you can find a plan that protects both your health and your wallet.

For easy, side-by-side health insurance comparisons, visit https://quotemaestro.com/ and find coverage that works for you—without the guesswork.

Meta Description

Learn how to compare health insurance quotes like a pro. Discover what to look for, how to avoid mistakes, and find the best coverage for your needs.

Frequently Asked Questions (FAQ)

What is the best way to compare health insurance quotes?

The best way is to compare premiums, deductibles, out-of-pocket limits, and coverage benefits together—not just price.

Why are health insurance quotes so different?

Quotes vary based on coverage level, provider networks, deductibles, and plan benefits.

Should I always choose the cheapest plan?

Not always. Cheaper plans often have higher out-of-pocket costs when you need care.

Can I compare health insurance quotes online?

Yes. Online platforms make it easy to compare multiple quotes quickly and accurately.

Where can I compare health insurance quotes?

You can compare health insurance quotes easily using platforms like https://quotemaestro.com/.