Enrolling in health insurance can feel overwhelming if you’re unsure what paperwork is required. Knowing the documents needed to enroll in health insurance ensures a smooth, hassle-free process, whether you’re signing up during Open Enrollment or a Special Enrollment Period.

This guide covers the essential documents, tips for preparation, and how to avoid delays during enrollment. You can also use platforms like 👉 QuoteMaestro to compare available health insurance plans and ensure you choose the best coverage.

Why Proper Documentation Matters

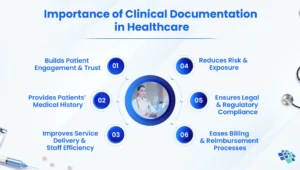

Having all necessary documents ready helps:

-

Verify your identity

-

Confirm household size and income

-

Ensure eligibility for Medicaid or marketplace subsidies

-

Avoid delays in coverage

Being prepared is key to completing enrollment efficiently and choosing the right plan. Using tools like 👉 QuoteMaestro can help you compare plan options after gathering your documents.

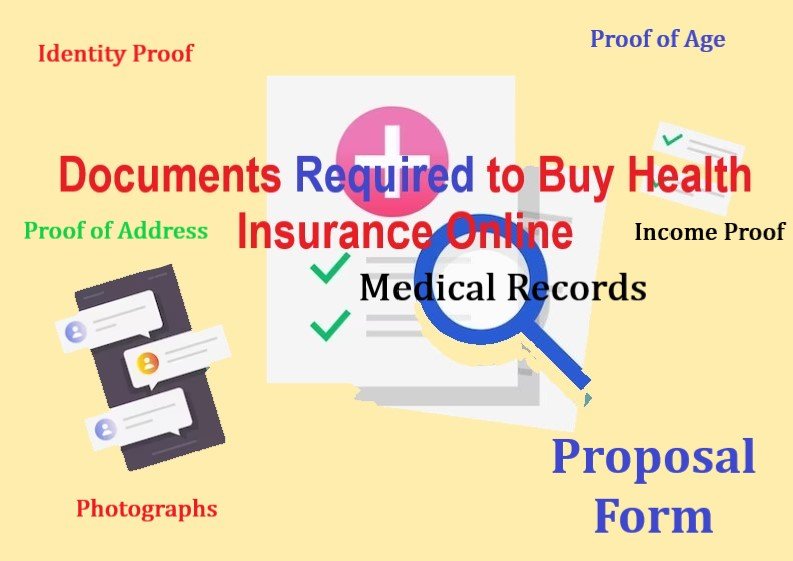

Common Documents Needed to Enroll in Health Insurance

While requirements can vary by plan type and state, most health insurance applications require the following:

1. Proof of Identity

-

Driver’s license or state ID

-

Passport

-

Birth certificate

2. Proof of Citizenship or Immigration Status

-

U.S. birth certificate or passport

-

Naturalization certificate

-

Permanent resident card (green card)

3. Social Security Number

Your SSN is used for verification and eligibility for premium tax credits.

4. Proof of Income

-

Pay stubs or W-2 forms

-

Tax returns (most recent year)

-

Unemployment benefits statements

This information helps determine eligibility for subsidies or Medicaid.

5. Current Health Coverage Information

If you have existing coverage, you may need:

-

Insurance card

-

Policy documents

-

Employer coverage information

6. Household Information

-

Names, ages, and Social Security numbers of family members

-

Dependent documentation for children or spouses

Having all documents ready allows you to compare insurance plans efficiently with tools like 👉 QuoteMaestro and select the right coverage.

Additional Documents for Special Situations

-

Proof of recent job loss (for Special Enrollment Period)

-

Marriage certificate (if adding a spouse)

-

Birth certificate or adoption papers (for adding children)

-

Proof of relocation (if moving to a new state)

Preparing these documents can also help you compare plans that are eligible under a Special Enrollment Period via 👉 QuoteMaestro.

Tips for a Smooth Enrollment Process

-

Gather documents in advance to avoid delays.

-

Keep digital copies for easy uploading to online applications.

-

Check state-specific requirements if applying for Medicaid or CHIP.

-

Verify dependent information to avoid errors that can delay coverage.

-

Compare available plans online to find the best option—tools like 👉 QuoteMaestro simplify the process.

FAQs: Documents Needed to Enroll in Health Insurance

What documents are required to enroll in health insurance?

You generally need proof of identity, proof of citizenship or legal status, Social Security numbers, proof of income, household information, and current coverage details. You can then use 👉 QuoteMaestro to compare plans.

Do I need my tax returns to enroll in health insurance?

Yes, your most recent tax return may be required to verify income and eligibility for subsidies.

What if I lost my ID or Social Security card?

You may need to request replacements before enrollment. Some states allow temporary alternatives for proof of identity.

Are documents different for Medicaid or CHIP?

Medicaid and CHIP may have additional requirements depending on state rules, such as proof of income or residency.

Can I upload documents online?

Yes. Most marketplace and state applications allow secure uploads of required documents. After uploading, you can compare plans to find the best coverage using 👉 QuoteMaestro.

Final Thoughts

Knowing the documents needed to enroll in health insurance saves time and ensures your coverage starts without delays. Preparing proof of identity, income, household information, and other essential paperwork is key. Once you have your documents ready, platforms like 👉 QuoteMaestro allow you to compare health insurance plans efficiently and select the coverage that best fits your needs and budget.