Choosing between two major insurers can feel overwhelming—especially when your health, budget, and favorite doctors are on the line. When comparing Blue Cross vs UnitedHealthcare coverage costs and networks, the best option really comes down to where you live, how often you use healthcare, and whether you want nationwide flexibility or strong local access.

Let’s walk through coverage, pricing, and provider access in a simple, no-fluff way so you can make a confident choice.

Coverage Options Compared

Blue Cross Blue Shield Association offers coverage through independent, state-based plans. This means your experience with Blue Cross can feel very different depending on where you live. In many states, Blue Cross has long-standing relationships with local hospitals and specialists, which can be a big win if you prefer staying close to home for care.

UnitedHealthcare provides more standardized, nationwide plans. This can be a huge advantage if you travel frequently, split time between states, or expect to move in the near future. Coverage tends to feel more consistent across regions.

What to know:

-

Both insurers cover essential health benefits

-

Both offer individual, family, and employer-sponsored plans

-

Coverage details still vary by state and employer contracts

When evaluating Blue Cross vs UnitedHealthcare coverage costs and network, think about whether you value local strength or national consistency more.

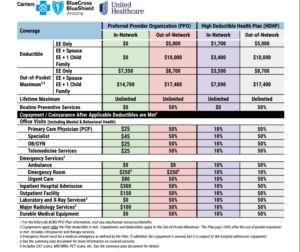

Costs and Premiums: What You’ll Pay

Pricing is one of the biggest deciding factors when people compare Blue Cross vs UnitedHealthcare coverage costs and network. There’s no universal “cheaper” option—it depends on where you live and the type of plan you choose.

Here’s what usually affects your costs:

-

Your zip code

-

Plan tier (Bronze, Silver, Gold, etc.)

-

Employer vs individual marketplace plans

-

Deductibles, copays, and out-of-pocket maximums

Common patterns people notice:

-

Blue Cross can be more affordable in some states due to strong local competition

-

UnitedHealthcare may offer lower premiums through employer-sponsored plans

-

Deductibles and copays can vary widely for both

💡 Real-world tip: Don’t just compare monthly premiums. Look at your total yearly cost (premium + deductible + out-of-pocket max). The cheapest monthly plan isn’t always the cheapest overall.

👉 Use platforms like 👉 QuoteMaestro to compare plans, networks, and pricing in minutes before enrolling.

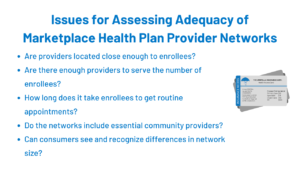

Network Size and Provider Access

Provider access is often where the difference becomes crystal clear in Blue Cross vs UnitedHealthcare coverage costs and network comparisons.

What people typically experience:

-

Blue Cross is known for strong regional hospital networks

-

UnitedHealthcare has one of the largest national provider networks

-

UnitedHealthcare is often better for multi-state access

-

Blue Cross may offer better coverage with local specialists

If keeping your current doctor is important, always double-check the provider directory for the specific plan you’re considering. Two plans from the same company can have completely different networks.

Which Is Better for Families, Travelers, and Remote Workers?

Your lifestyle plays a huge role in choosing between these two insurers.

Families

-

Blue Cross often has strong pediatric coverage and regional hospital partnerships

-

UnitedHealthcare may offer better digital tools for managing family benefits and claims

Frequent Travelers

-

UnitedHealthcare’s nationwide network can be more convenient when you’re away from home

-

Blue Cross members may face more out-of-network situations when traveling far from their home state

Remote Workers & Movers

-

UnitedHealthcare is often easier if you expect to relocate

-

Blue Cross can be an excellent long-term choice if you plan to stay in one region

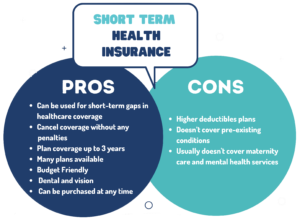

Pros and Cons at a Glance

Blue Cross Pros

-

Strong local hospital partnerships

-

Trusted brand in many states

-

Great choice if you stay within one region

Blue Cross Cons

-

Service quality and network vary by state

-

Less consistent nationwide coverage

UnitedHealthcare Pros

-

Huge national provider network

-

Strong mobile app and digital tools

-

More convenient for travelers and relocators

UnitedHealthcare Cons

-

Some plans have narrower networks

-

Premiums can be higher in certain regions

FAQs: Blue Cross vs UnitedHealthcare Coverage, Costs, and Network

Which has the larger provider network?

UnitedHealthcare generally has broader nationwide access, while Blue Cross often shines at the regional level.

Which one is cheaper?

It depends on your location and plan type. Some areas favor Blue Cross on pricing, while others favor UnitedHealthcare.

Can I keep my current doctor?

Possibly—but you must check the provider directory for the exact plan you’re considering. Network access varies by plan, even within the same insurer.

Is one better for long-term coverage?

Both are reliable long-term insurers. The better choice depends on how stable your location is and how often you use healthcare.

Final Thoughts

There’s no one-size-fits-all winner. The smartest move is comparing Blue Cross vs UnitedHealthcare coverage costs and network side by side based on your lifestyle, doctors, and budget. A little research now can save you a lot of stress (and money) later.

👉 Use platforms like 👉 QuoteMaestro to compare plans, networks, and pricing in minutes before enrolling.