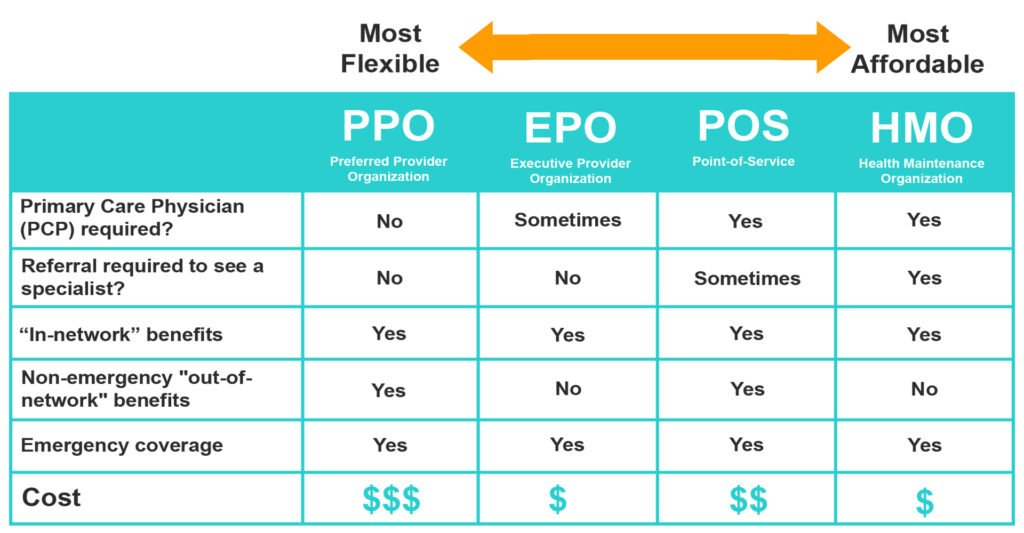

Choosing between PPO and HMO plans can be confusing—especially when two major insurers are involved. Understanding PPO vs HMO options Blue Cross compared to UnitedHealthcare helps you pick the right balance of flexibility, cost, and provider access for your lifestyle.

Whether you want freedom to see specialists without referrals or lower premiums with coordinated care, here’s how these two companies stack up.

PPO vs HMO Options Blue Cross Compared to UnitedHealthcare: Plan Types Explained

Blue Cross Blue Shield Association offers both PPO and HMO plans through its state-based member companies. Availability and rules can vary by state, but you’ll often find:

-

PPOs with wider provider access

-

HMOs with lower monthly premiums and coordinated care

UnitedHealthcare also offers PPO and HMO plans nationwide, with more standardized rules across states—especially through employer plans and marketplace options.

When comparing PPO vs HMO options Blue Cross compared to UnitedHealthcare, check which plan types are actually offered in your ZIP code.

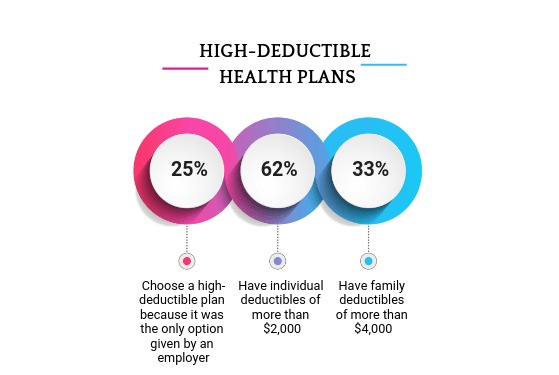

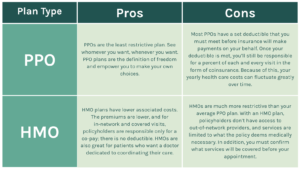

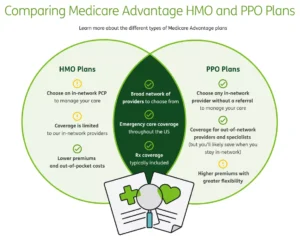

PPO vs HMO Options Blue Cross Compared to UnitedHealthcare: Costs & Premiums

Costs are a big factor in choosing between PPOs and HMOs:

-

PPOs usually have higher premiums but more flexibility

-

HMOs typically cost less monthly but require in-network care and referrals

-

Deductibles and copays vary by state and employer

In some regions, Blue Cross HMOs are more affordable due to strong local networks. UnitedHealthcare PPOs can be competitive for employer-sponsored plans with broader national access.

👉 Use platforms like 👉 QuoteMaestro to compare PPO vs HMO options side-by-side and find the best mix of cost and flexibility for your needs.

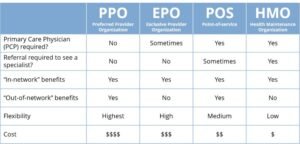

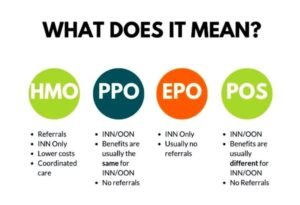

PPO vs HMO Options Blue Cross Compared to UnitedHealthcare: Networks & Referrals

Here’s where lifestyle really matters:

PPO Plans (Both Insurers)

-

See specialists without referrals

-

Use out-of-network providers (at higher cost)

-

Better for travelers or people who want flexibility

HMO Plans (Both Insurers)

-

Lower premiums

-

Must choose a primary care doctor

-

Referrals required for specialists

-

Care limited to in-network providers (except emergencies)

UnitedHealthcare often has stronger multi-state networks, while Blue Cross may offer better access to local hospitals and specialists.

👉 Use platforms like 👉 QuoteMaestro to compare PPO vs HMO options side-by-side and find the best mix of cost and flexibility for your needs.

Who Should Choose PPO vs HMO?

When weighing PPO vs HMO options Blue Cross compared to UnitedHealthcare, think about how you actually use healthcare:

Choose a PPO if you:

-

Travel frequently

-

Want to see specialists without referrals

-

Need flexibility across states

Choose an HMO if you:

-

Want lower monthly costs

-

Prefer coordinated care through a primary doctor

-

Mostly use local providers

👉 Use platforms like 👉 QuoteMaestro to compare PPO vs HMO options side-by-side and find the best mix of cost and flexibility for your needs.

FAQs: PPO vs HMO Options Blue Cross Compared to UnitedHealthcare

Are PPO plans always better than HMOs?

Not necessarily. PPOs offer flexibility, but HMOs can save money if you’re comfortable staying in-network and using referrals.

Do both insurers offer PPO and HMO plans everywhere?

Availability depends on your state and employer. Some regions may have more options with one insurer than the other.

Which is better for families?

HMOs can be cost-effective for families with predictable care needs, while PPOs work better for families that travel or need specialist access.

Can I switch between PPO and HMO later?

Usually during Open Enrollment or after a qualifying life event, depending on your plan type.

Final Thoughts

There’s no universal winner. The right choice depends on your budget, travel habits, and how much flexibility you want. Comparing PPO vs HMO options Blue Cross compared to UnitedHealthcare side-by-side helps you avoid surprises and choose coverage that actually fits your life.

👉 Use platforms like 👉 QuoteMaestro to compare PPO vs HMO options side-by-side and find the best mix of cost and flexibility for your needs.