Choosing health insurance isn’t just about monthly premiums — what really hits your wallet is what you pay when you actually use your plan. If you’re stuck deciding between Blue Cross vs UnitedHealthcare costs, you’re asking the right question.

Both providers are huge names in the insurance world, but Blue Cross vs UnitedHealthcare costs can feel confusing and unpredictable. Let’s break it down in a simple, human way so you can decide which one might cost you less when life actually happens.

When comparing Blue Cross vs UnitedHealthcare costs, there’s no one-size-fits-all winner. The best choice in the Blue Cross vs UnitedHealthcare costs comparison depends on how often you use healthcare, what kind of care you need, and which doctors you want to keep.

Who Are Blue Cross and UnitedHealthcare?

Before we dive deeper into Blue Cross vs UnitedHealthcare costs, here’s a quick snapshot of both providers.

🏥 Blue Cross Blue Shield

Blue Cross Blue Shield isn’t one company — it’s a network of independent insurers operating in different states. That means Blue Cross vs UnitedHealthcare costs can vary depending on where you live and which local Blue Cross plan you’re enrolled in.

🏥 UnitedHealthcare

UnitedHealthcare is a single nationwide insurer with a massive provider network and standardized plan structures across states, which can make Blue Cross vs UnitedHealthcare costs easier to compare across regions.

Both offer individual plans, employer insurance, Medicare, and Medicaid options — but how much you pay can differ a lot between them.

👉 Pro tip: You can compare personalized health plans and out-of-pocket costs using tools like https://quotemaestro.com/ to see real numbers based on your location and needs.

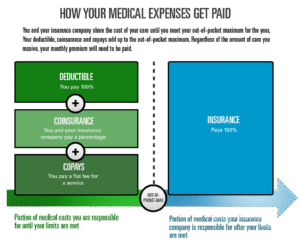

What “Out-of-Pocket Costs” Really Mean

When people compare Blue Cross vs UnitedHealthcare out-of-pocket costs, they’re usually talking about:

-

Deductibles

-

Copays

-

Coinsurance

-

Out-of-pocket maximums

These costs decide how much you actually pay when you go to the doctor, pick up prescriptions, or land in the ER.

👉 Pro tip: You can compare personalized health plans and out-of-pocket costs using tools like https://quotemaestro.com/ to see real numbers based on your location and needs.

Blue Cross vs UnitedHealthcare Out-of-Pocket Costs: Comparison

Here’s what you’ll usually notice when comparing Blue Cross vs UnitedHealthcare out-of-pocket costs across popular plans (numbers vary by state and plan type):

| Cost Type | Blue Cross | UnitedHealthcare |

|---|---|---|

| Deductibles | Lower on HMO plans | Lower on PPO plans |

| Copays | Lower for primary care | Lower for specialist visits |

| Coinsurance | Moderate | Often slightly lower |

| Out-of-Pocket Max | Can be higher in some regions | More competitive on average |

👉 Pro tip: You can compare personalized health plans and out-of-pocket costs using tools like https://quotemaestro.com/ to see real numbers based on your location and needs.

Which Is Better for You?

Blue Cross may be better if:

-

You mainly need routine doctor visits

-

Your preferred local hospitals are in-network

-

You want lower upfront medical costs

UnitedHealthcare may be better if:

-

You see specialists often

-

You travel frequently

-

You want broader nationwide coverage

Comparing Blue Cross vs UnitedHealthcare out-of-pocket costs should always include checking your doctors and medications first.

👉 Pro tip: You can compare personalized health plans and out-of-pocket costs using tools like https://quotemaestro.com/ to see real numbers based on your location and needs.

FAQs (With New Focus Keyword Used)

1. Which is cheaper overall for Blue Cross vs UnitedHealthcare costs?

There’s no universal winner for Blue Cross vs UnitedHealthcare costs because pricing depends on your state, plan type, and healthcare usage.

2. Are Blue Cross vs UnitedHealthcare costs higher for families?

Yes, Blue Cross vs UnitedHealthcare costs for family plans are usually higher than individual plans due to higher deductibles and out-of-pocket maximums.

3. How can I lower my Blue Cross vs UnitedHealthcare costs?

To reduce Blue Cross vs UnitedHealthcare costs, choose in-network providers, compare plan tiers, and estimate yearly medical usage before enrolling.

4. Are out-of-pocket costs higher for families?

Yes. Family plans under both providers usually have higher deductibles and out-of-pocket maximums. When comparing Blue Cross vs UnitedHealthcare out-of-pocket costs, family coverage can change the math significantly.

5. How can I find the lowest out-of-pocket plan in my area?

To accurately compare Blue Cross vs UnitedHealthcare out-of-pocket costs, use a comparison platform, review plan brochures, and confirm your doctors and prescriptions are in-network before enrolling.

Final Thoughts

When comparing Blue Cross vs UnitedHealthcare out-of-pocket costs, the “cheapest” plan on paper isn’t always the cheapest in real life. Your doctors, medications, travel habits, and how often you use care matter more than brand names.

👉 Pro tip: You can compare personalized health plans and out-of-pocket costs using tools like https://quotemaestro.com/ to see real numbers based on your location and needs.