High-deductible health plans worth it is a question more people are asking as healthcare costs keep rising and monthly premiums get harder to manage. On paper, these plans look attractive because they’re cheaper each month. In real life, though, they can either save you money—or seriously hurt your wallet.

Let’s break down whether high-deductible health plans worth it really makes sense for you in 2026, in plain English.

What Are High-Deductible Health Plans?

High-deductible health plans worth it usually refers to insurance plans with lower monthly premiums but much higher deductibles. That means you pay more out of pocket before your insurance starts helping.

In most cases, HDHPs are paired with an Health Savings Account (HSA), which lets you save pre-tax money for medical expenses.

So when people ask if high-deductible health plans worth it, they’re really asking:

“Is the lower monthly premium worth the risk of higher upfront medical bills?”

Pros: When High-Deductible Health Plans Are Worth It

For some people, high-deductible health plans worth it can absolutely be true:

-

✅ Lower monthly premiums

-

✅ Access to an HSA (tax advantages = real savings)

-

✅ Good for healthy people who rarely see doctors

-

✅ Useful if you have emergency savings

-

✅ Often paired with employer contributions to HSA

If you’re young, healthy, and financially prepared, high-deductible health plans worth it can help you save money long-term.

If you’re comparing real plans, tools like https://quotemaestro.com/ can help you estimate yearly costs instead of guessing.

Cons: When High-Deductible Health Plans Are NOT Worth It

For others, high-deductible health plans worth it is a risky gamble:

-

❌ High upfront costs before coverage kicks in

-

❌ Stressful if you have chronic conditions

-

❌ Harder to budget for surprise medical bills

-

❌ People may delay care due to cost

-

❌ Out-of-pocket maximums can be painful

If you visit doctors often, take prescriptions, or have ongoing conditions, high-deductible health plans worth it may not apply to you.

If you’re comparing real plans, tools like https://quotemaestro.com/ can help you estimate yearly costs instead of guessing.

Real-Life Scenarios: Are High-Deductible Health Plans Worth It for You?

Let’s make high-deductible health plans worth it easier to visualize:

High-deductible health plans worth it if you:

-

Rarely go to the doctor

-

Have no chronic conditions

-

Have at least 3–6 months of emergency savings

-

Want to build HSA savings

High-deductible health plans NOT worth it if you:

-

Have frequent medical visits

-

Take multiple prescriptions

-

Have kids with regular healthcare needs

-

Live paycheck to paycheck

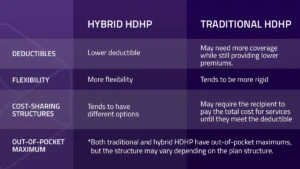

HDHP vs Traditional Plans: Cost Comparison

| Feature | HDHP | Traditional Plan |

|---|---|---|

| Monthly Premium | Lower | Higher |

| Deductible | High | Low |

| Copays | Higher | Lower |

| Best For | Healthy individuals | Frequent care users |

This table alone shows why high-deductible health plans worth it depends entirely on how you use healthcare.

How to Decide If a High-Deductible Health Plan Is Worth It

To know if high-deductible health plans worth it for you, ask yourself:

-

Can I afford the deductible if something unexpected happens?

-

Do I have savings to cover medical bills?

-

Will I use healthcare often this year?

-

Am I eligible for an HSA and willing to use it?

If you’re comparing real plans, tools like https://quotemaestro.com/ can help you estimate yearly costs instead of guessing.

FAQs: High-Deductible Health Plans Worth It

1. Are high-deductible health plans worth it for families?

High-deductible health plans worth it can be risky for families because kids often need more frequent care, which means higher out-of-pocket costs.

2. Are high-deductible health plans worth it if I’m healthy?

Yes, high-deductible health plans worth it often make sense for healthy individuals with savings and low medical usage.

3. Can an HSA make high-deductible health plans worth it?

Absolutely. The tax benefits of an HSA can make high-deductible health plans worth it financially over time.

4. What happens if I get sick unexpectedly?

This is the biggest risk with high-deductible health plans worth it—you’ll pay more upfront before insurance helps.

5. Are HDHPs better than PPO plans?

Not always. High-deductible health plans worth it compared to PPOs depends on how often you use care and how much risk you can handle.

Final Verdict

So, are high-deductible health plans worth it in 2026?

👉 Yes, if you’re healthy, financially prepared, and want lower monthly premiums.

👉 No, if you need frequent care or can’t comfortably cover a high deductible.