Health insurance can be confusing—especially when you’re comparing ACA vs Medicare. While both provide essential health coverage, they are designed for very different groups of people and life stages. Choosing the wrong one (or assuming you qualify when you don’t) can lead to coverage gaps and unexpected costs.

If you’re unsure whether the Affordable Care Act (ACA) or Medicare is right for you, this guide breaks everything down in simple terms.

What Is ACA Health Insurance?

The Affordable Care Act (ACA), often called Obamacare, created a health insurance marketplace where individuals and families can purchase coverage—usually with income-based financial assistance.

Who ACA Coverage Is For

ACA plans are typically designed for:

-

Adults under age 65

-

Freelancers, self-employed individuals, and gig workers

-

People without employer-sponsored insurance

-

Recent graduates or career changers

ACA plans are available through federal or state marketplaces and must cover essential health benefits.

Key Features of ACA Plans

-

Coverage for preventive care, prescriptions, and hospital services

-

Guaranteed coverage regardless of pre-existing conditions

-

Income-based subsidies that can lower monthly premiums

-

Multiple plan tiers (Bronze, Silver, Gold)

ACA coverage is often the most affordable option for people who don’t qualify for Medicare.

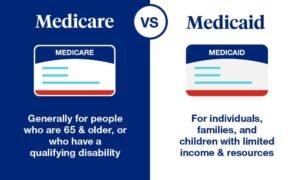

What Is Medicare?

Medicare is a federal health insurance program primarily designed for older adults and certain individuals with disabilities.

Who Medicare Is For

Medicare generally covers:

-

Adults aged 65 and older

-

People under 65 with qualifying disabilities

-

Individuals with end-stage renal disease or ALS

Unlike ACA plans, Medicare eligibility is based on age or medical status, not income.

Parts of Medicare Explained

-

Part A: Hospital insurance

-

Part B: Medical insurance (doctor visits, outpatient care)

-

Part C (Medicare Advantage): Private plans combining Parts A and B

-

Part D: Prescription drug coverage

Many people also purchase Medigap plans to help cover out-of-pocket costs.

ACA vs Medicare: Key Differences at a Glance

Understanding the difference between ACA vs Medicare comes down to eligibility, cost structure, and enrollment rules.

Eligibility

-

ACA: Based on income and lack of other coverage

-

Medicare: Based on age (65+) or disability

Cost Structure

-

ACA: Monthly premiums may be reduced with subsidies

-

Medicare: Part A is often premium-free; Parts B, C, and D may have monthly costs

Enrollment Periods

-

ACA: Open enrollment or special enrollment after qualifying life events

-

Medicare: Initial enrollment around your 65th birthday, plus annual enrollment periods

Flexibility

-

ACA: Ideal for working-age adults and families

-

Medicare: Designed for retirees and eligible individuals with disabilities

Which One Is Right for You?

Choosing between ACA vs Medicare depends entirely on your situation.

You may want ACA coverage if:

-

You’re under 65

-

You don’t have employer-based insurance

-

You’re self-employed or between jobs

You may need Medicare if:

-

You’re turning 65

-

You’re retiring

-

You qualify due to a disability

Some people transition from ACA to Medicare when they turn 65, making timing and planning especially important.

Avoiding Coverage Gaps During Transitions

One common mistake is assuming ACA coverage automatically switches to Medicare. It doesn’t. You must actively enroll in Medicare when eligible—or risk penalties and gaps in coverage.

Planning ahead ensures:

-

No lapse in health insurance

-

No late enrollment penalties

-

Smooth coordination between plans

For easy comparisons and guidance, trusted platforms like https://quotemaestro.com/ can help you explore ACA and Medicare options side by side.

Final Thoughts: ACA vs Medicare Made Simple

When it comes to ACA vs Medicare, there’s no one-size-fits-all answer. ACA plans are ideal for working-age individuals and families, while Medicare is designed to support older adults and those with qualifying conditions.

Understanding the differences helps you make confident decisions, avoid costly mistakes, and stay protected at every stage of life. Whether you’re enrolling for the first time or planning a transition, choosing the right coverage matters.

Explore personalized ACA and Medicare options at https://quotemaestro.com/ and find health insurance that fits your needs today.

Frequently Asked Questions (FAQ)

Can I have ACA and Medicare at the same time?

Generally, once you qualify for Medicare, ACA subsidies end. Medicare becomes your primary coverage.

Is ACA cheaper than Medicare?

ACA can be more affordable for younger individuals with subsidies, while Medicare is often more cost-effective for seniors.

Do I need to cancel ACA when I enroll in Medicare?

Yes. You should end your ACA plan when Medicare coverage begins to avoid paying for duplicate insurance.

What happens if I miss Medicare enrollment?

You may face late enrollment penalties and gaps in coverage, so enrolling on time is critical.

Where can I compare ACA and Medicare plans?

You can compare ACA and Medicare options easily through platforms like https://quotemaestro.com/.