If you’re healthy and rarely need medical care, paying for an expensive insurance plan may feel unnecessary. Still, skipping coverage entirely can be risky. Understanding the best insurance plan if you rarely go to the doctor helps you balance low monthly costs with protection against unexpected emergencies like accidents, sudden illnesses, or hospital stays.

This guide breaks down the best plan options, what to avoid, and how to choose a plan that fits a low-usage, budget-conscious lifestyle—without sacrificing peace of mind.

Why Healthy People Still Need Health Insurance

Even if you rarely visit a doctor, medical emergencies don’t always give warnings. The best insurance plan if you rarely go to the doctor protects you from overwhelming medical bills while keeping monthly premiums affordable.

Health insurance typically still covers:

-

Preventive care at no extra cost

-

Emergency room visits

-

Hospitalization and surgeries

-

Prescription drugs for urgent needs

For healthy individuals, insurance is less about frequent use and more about financial protection.

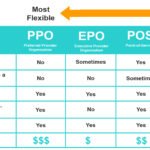

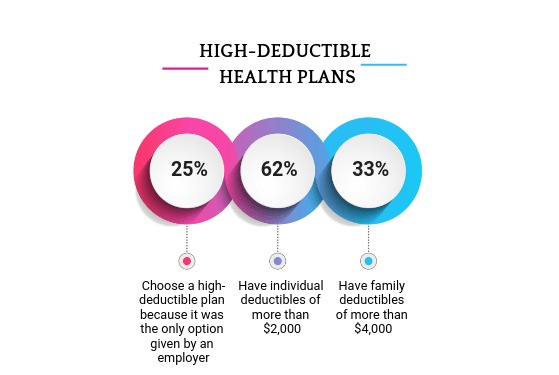

High-Deductible Health Plans (HDHPs) for Low Medical Use

For many healthy individuals, a high-deductible health plan (HDHP) is often the best insurance plan if you rarely go to the doctor.

Why HDHPs work well:

-

Lower monthly premiums compared to traditional plans

-

Coverage for major medical events and emergencies

-

Preventive care is usually covered before the deductible

HDHPs are ideal if you can manage higher out-of-pocket costs in rare situations while enjoying lower monthly payments year-round.

Comparing plans annually is no longer optional—it’s essential. Platforms like

👉 https://quotemaestro.com/

Health Savings Accounts (HSAs): A Smart Pairing for Healthy Individuals

HDHPs can be paired with a Health Savings Account (HSA), making them even more attractive for people with minimal healthcare needs.

Benefits of an HSA include:

-

Tax-free contributions

-

Tax-free growth

-

Tax-free withdrawals for qualified medical expenses

If you rarely go to the doctor, an HDHP paired with an HSA is often considered the best insurance plan if you rarely go to the doctor because it combines low premiums with long-term savings potential.

Comparing plans annually is no longer optional—it’s essential. Platforms like

👉 https://quotemaestro.com/

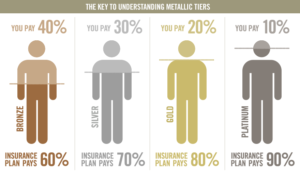

Low-Premium Bronze Plans for Basic Coverage

Bronze plans are designed for individuals who don’t expect frequent medical visits. These plans typically offer:

-

The lowest monthly premiums on the ACA marketplace

-

Higher deductibles

-

Strong protection against major medical costs

For healthy individuals who want basic coverage and emergency protection, a Bronze plan may be the best insurance plan if you rarely go to the doctor.

Catastrophic Health Insurance Plans

Catastrophic health insurance plans are another option for people with very low medical usage.

Key features:

-

Extremely low monthly premiums

-

Very high deductibles

-

Coverage focused mainly on serious emergencies

These plans are best suited for younger, healthy individuals who want protection against worst-case scenarios while keeping costs as low as possible.

Comparing plans annually is no longer optional—it’s essential. Platforms like

👉 https://quotemaestro.com/

Preventive Care Still Matters—Even If You’re Healthy

Even if you rarely see a doctor, preventive care plays a critical role in maintaining long-term health. The best insurance plan if you rarely go to the doctor still includes preventive services at little or no cost.

Most plans cover:

-

Annual wellness visits

-

Vaccinations

-

Screenings for common conditions

Preventive care helps catch problems early—before they become expensive.

When a Low-Cost Plan Might Not Be the Best Choice

A low-premium plan may not be the best insurance plan if you rarely go to the doctor if:

-

You expect upcoming medical procedures

-

You take regular or specialty prescription medications

-

You prefer predictable copays instead of large deductibles

In these situations, paying a slightly higher premium can actually reduce your overall healthcare costs.

How to Choose the Best Insurance Plan If You Rarely Go to the Doctor

When comparing plans, focus on the factors that matter most for low medical usage:

-

Monthly premium affordability

-

Deductible amount

-

Out-of-pocket maximum

-

Emergency and hospital coverage

-

Provider network size

Balancing these elements helps ensure you choose the best insurance plan if you rarely go to the doctor without overpaying.

Comparing plans annually is no longer optional—it’s essential. Platforms like

👉 https://quotemaestro.com/

Compare Plans Every Year to Avoid Overpaying

Health insurance plans change annually—premiums, deductibles, and benefits don’t stay the same. Even if your health hasn’t changed, your plan might not be the best deal anymore.

Comparing plans annually is no longer optional—it’s essential. Platforms like

👉 https://quotemaestro.com/

make it easier to review options and identify the best insurance plan if you rarely go to the doctor based on current pricing and coverage.

FAQs: Best Insurance Plan If You Rarely Go to the Doctor

What is the best insurance plan if you rarely go to the doctor?

A high-deductible health plan (HDHP), Bronze plan, or catastrophic plan is often the best choice due to low premiums and emergency coverage.

Is it worth having health insurance if I’m healthy?

Yes. Health insurance protects you from high medical costs caused by unexpected accidents or serious illnesses.

Can I skip health insurance if I never use it?

Skipping insurance can expose you to significant financial risk if an emergency occurs.

Are catastrophic plans good for healthy people?

Yes, catastrophic plans can work well for young, healthy individuals seeking low premiums and emergency protection.

Should I choose a plan with an HSA?

If eligible, an HSA paired with an HDHP is one of the best options for healthy individuals who rarely need medical care.

Final Thoughts

Choosing the best insurance plan if you rarely go to the doctor means prioritizing low premiums, strong emergency coverage, and long-term value. High-deductible plans, Bronze plans, catastrophic coverage, and HSAs often provide the right balance for healthy individuals who want protection without overspending.