Choosing a health insurance plan can feel overwhelming. It’s not just about monthly premiums — what really affects your wallet are deductibles, copays, and out-of-pocket costs. If you’re deciding between Blue Cross Blue Shield vs UnitedHealthcare, you’re asking the right question.

Both providers are major players in the health insurance market, but their plans differ in coverage, costs, and provider networks. Let’s break it down in a simple, human way so you can see which health plan is likely better for you in 2026.

Who Are Blue Cross Blue Shield and UnitedHealthcare?

🏥 Blue Cross Blue Shield

Blue Cross Blue Shield isn’t a single company. It’s a federation of independent insurers operating across the U.S., which means coverage, costs, and network size can vary by state.

🏥 UnitedHealthcare

UnitedHealthcare is a single nationwide insurer with standardized plans and a broad provider network across the country, making it easier to compare costs and coverage no matter where you live.

Both offer individual and family plans, employer coverage, Medicare, and Medicaid options.

Blue Cross Blue Shield vs UnitedHealthcare: Key Differences in 2026

When comparing Blue Cross Blue Shield vs UnitedHealthcare, there are several factors that can affect which plan is better for you:

| Factor | Blue Cross Blue Shield | UnitedHealthcare |

|---|---|---|

| Deductibles | Often lower on HMO plans | Competitive on PPO plans |

| Copays | Lower for primary care visits | Lower for specialists |

| Coinsurance | Moderate | Slightly lower on average |

| Out-of-Pocket Maximum | Can be higher depending on state | Usually more competitive |

| Network Size | Strong regional coverage | Nationwide network, good for travel |

Who Might Prefer Which Plan?

Blue Cross Blue Shield may be better if you:

-

Visit your primary care doctor frequently

-

Prefer lower upfront costs for routine care

-

Stay mainly in your local area

UnitedHealthcare may be better if you:

-

See specialists regularly

-

Travel or move across states often

-

Want broader access to nationwide providers

FAQs: Blue Cross Blue Shield vs UnitedHealthcare

1. Which health plan is cheaper overall?

There’s no universal answer. Blue Cross Blue Shield vs UnitedHealthcare costs vary by state, plan type, and usage. Use platforms like QuoteMaestro to compare your personalized costs.

2. Do family plans cost more?

Yes. Family coverage under both Blue Cross Blue Shield vs UnitedHealthcare typically has higher deductibles and out-of-pocket maximums than individual plans.

3. How can I lower my out-of-pocket costs?

To reduce Blue Cross Blue Shield vs UnitedHealthcare out-of-pocket costs, choose in-network providers, review plan tiers, and estimate your yearly medical usage.

4. Which plan has a larger network?

UnitedHealthcare generally offers a broader national network, while Blue Cross Blue Shield excels in strong regional coverage depending on your state.

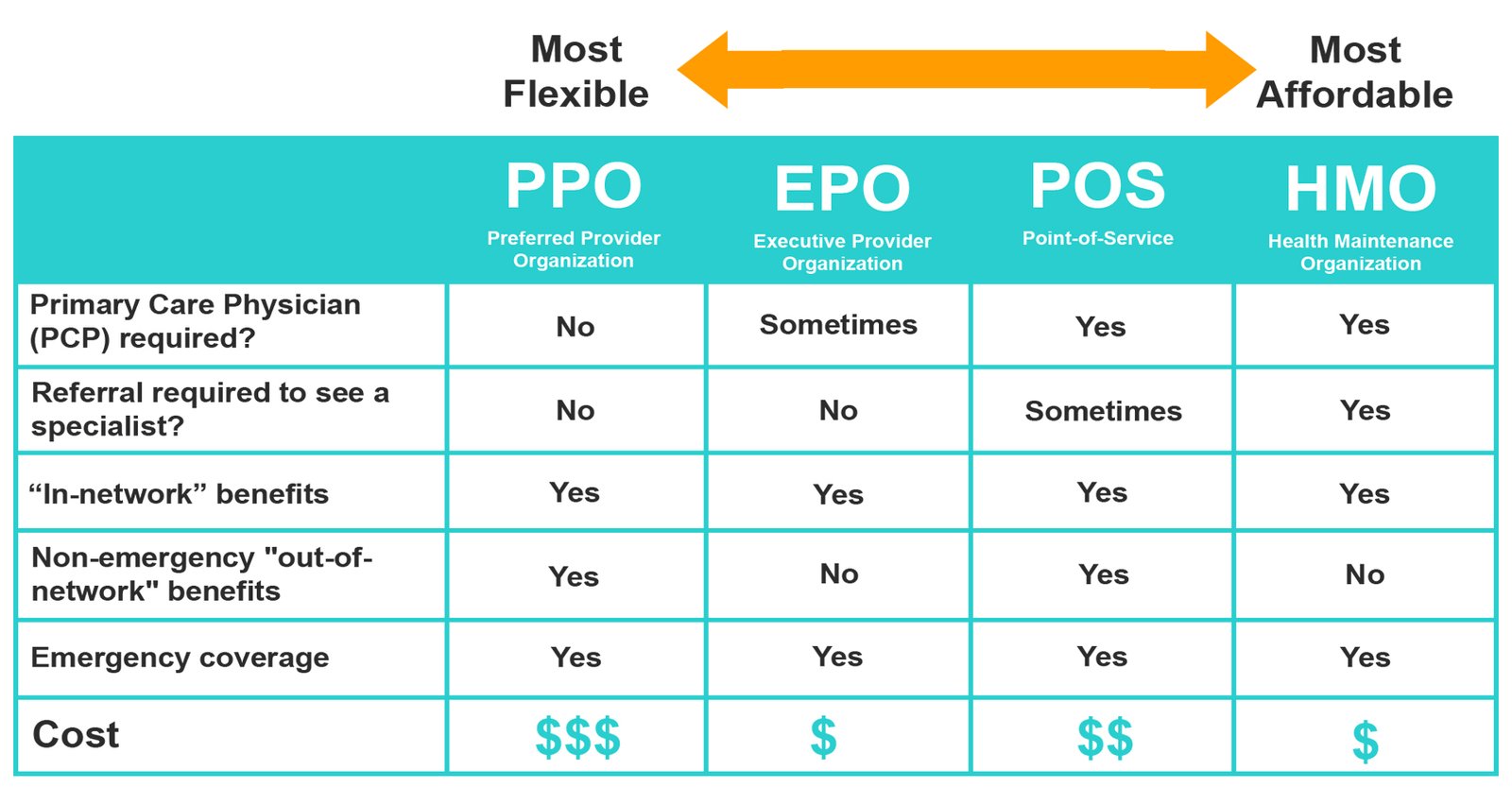

5. Is it better to choose an HMO or PPO?

HMOs usually have lower premiums and out-of-pocket costs but limit provider choice. PPOs offer more flexibility but may cost more. Comparing Blue Cross Blue Shield vs UnitedHealthcare HMO vs PPO plans is key in 2026.

Final Thoughts

When deciding between Blue Cross Blue Shield vs UnitedHealthcare, there’s no one-size-fits-all answer. Your ideal plan depends on your healthcare habits, preferred providers, travel, and budget. Use tools like QuoteMaestro to see real plan costs and make an informed choice for 2026.