Choosing a health insurance plan isn’t just about premiums or deductibles — how your provider supports you matters just as much. If you’re evaluating Blue Cross vs Aetna customer service, you want to know which company responds faster, resolves problems effectively, and makes your healthcare experience smoother.

Both companies are major U.S. insurers, but their customer service models and member experiences differ. In this guide, we’ll break down Blue Cross vs Aetna customer service, explore strengths and weaknesses, and give tips for picking the best plan for you in 2026.

Who Are Blue Cross and Aetna?

🏥 Blue Cross Blue Shield

Blue Cross Blue Shield is a federation of independent insurers across the United States. Each regional Blue Cross plan can differ in coverage, pricing, and customer support. While some areas offer excellent member services, others may have slower claim handling. Understanding your local plan is key when evaluating Blue Cross vs Aetna customer service.

🏥 Aetna

Aetna is a nationwide insurer and CVS Health subsidiary known for standardizing its customer support across all states. Members benefit from robust digital tools, 24/7 support, and streamlined claim processing, making Blue Cross vs Aetna customer service more predictable nationwide.

Why Customer Service Matters in Health Insurance

When comparing Blue Cross vs Aetna customer service, it’s not just about politeness. Good service affects:

-

Claim processing speed – Faster claims mean less stress and quicker reimbursements.

-

Ease of communication – Prompt phone, chat, or email support saves time.

-

Problem resolution – Quick solutions prevent unexpected bills or denied claims.

-

Digital experience – Mobile apps and online portals help you manage care efficiently.

Poor service can turn routine doctor visits into frustrating experiences. That’s why Blue Cross vs Aetna customer service should be a top consideration, not an afterthought.

Blue Cross vs Aetna Customer Service: Head-to-Head Comparison

| Factor | Blue Cross | Aetna |

|---|---|---|

| Claims Processing | Moderate, depends on region | Fast, standardized nationwide |

| Phone & Email Support | Varies by local plan | 24/7 support available |

| Mobile App & Portal | Available; quality differs by state | Highly rated, user-friendly |

| Problem Resolution | Good but inconsistent | Reliable and centralized |

| Member Satisfaction | 70–80% (regional variation) | 80–85% nationwide average |

Key Takeaways:

-

Blue Cross excels in local knowledge and personal support.

-

Aetna leads in consistency, speed, and digital tools.

-

Your personal experience may vary based on your local Blue Cross plan, which is why reading reviews and testing customer support can help.

Tips to Maximize Your Customer Service Experience

-

Know your local contacts: If you have Blue Cross, find your state’s customer service numbers for quicker resolution.

-

Use digital tools: Both Blue Cross and Aetna offer apps and online portals. Aetna’s app is especially intuitive for claims, ID cards, and doctor searches.

-

Keep records: Save emails, claim numbers, and call notes to avoid delays.

-

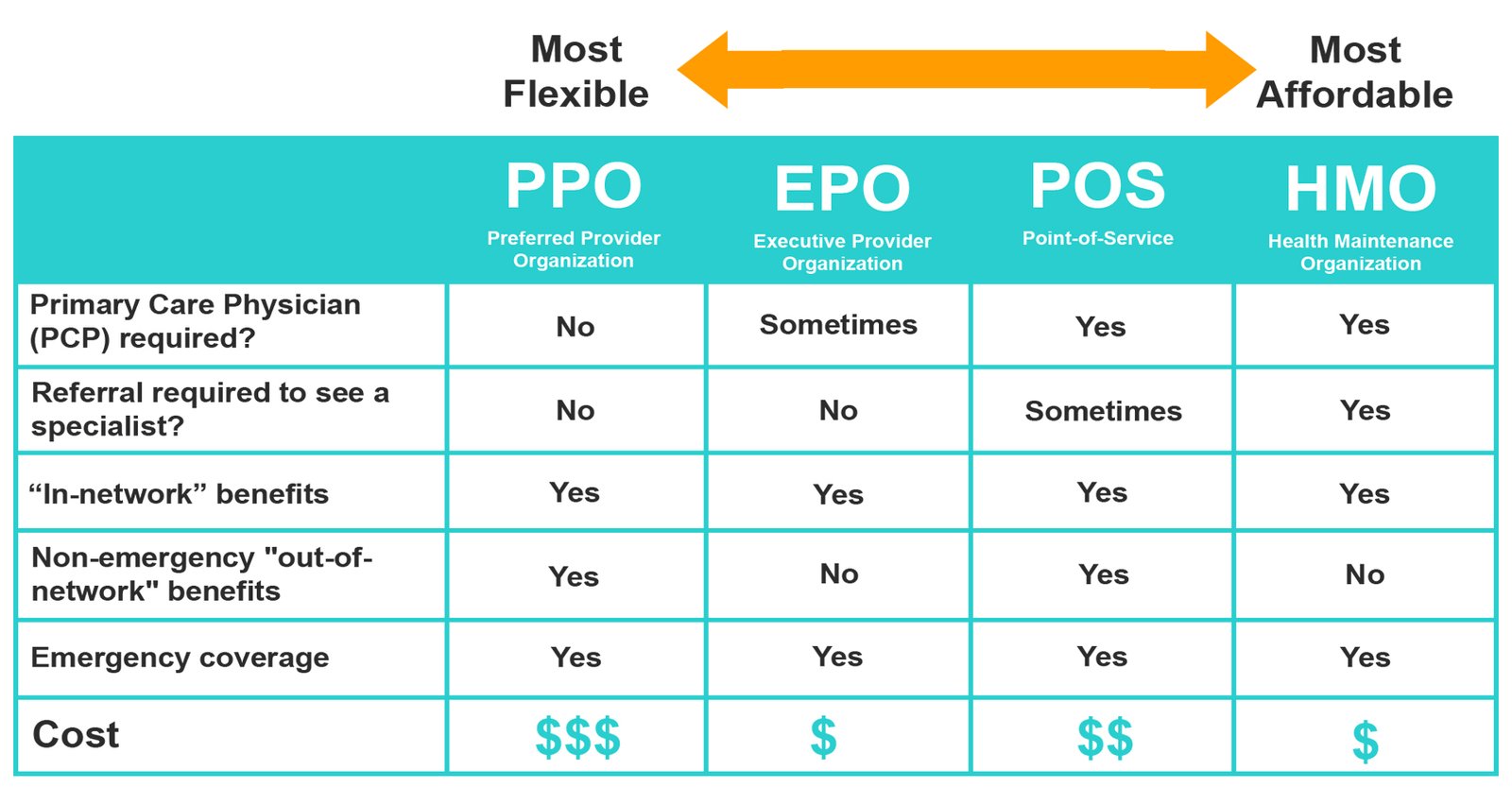

Check provider networks: Sometimes “poor service” is actually an out-of-network issue, not the insurer’s fault.

-

Compare before enrolling: Platforms like QuoteMaestro allow you to see plan details, including support features and reviews.

FAQs: Blue Cross vs Aetna Customer Service

1. Which insurer has faster claim processing?

Aetna is generally faster due to standardized nationwide procedures, while Blue Cross vs Aetna customer service can vary depending on your state and regional plan.

2. Is Blue Cross or Aetna easier to reach by phone or email?

Aetna offers 24/7 support nationwide, whereas Blue Cross availability depends on your local plan. This is an important factor in Blue Cross vs Aetna customer service.

3. Does digital access improve customer service?

Yes. Aetna’s mobile app and online portal make it easy to track claims, view ID cards, and manage care. Blue Cross apps vary by region, affecting the Blue Cross vs Aetna customer service experience.

4. Are there differences in problem resolution quality?

Aetna tends to resolve issues consistently, while Blue Cross can vary regionally. Knowing your local plan helps you evaluate Blue Cross vs Aetna customer service.

5. Can choosing the right plan reduce headaches?

Absolutely. Comparing Blue Cross vs Aetna customer service features before enrollment ensures smoother claims and better support, saving time and stress later.

Final Thoughts

When deciding between Blue Cross vs Aetna customer service, think about what matters most to you:

-

Local, personal support? Blue Cross may fit better.

-

Fast, digital-first, nationwide consistency? Aetna is likely the stronger choice.

Always compare plans in detail using platforms like QuoteMaestro to see customer reviews, support features, and claims efficiency before enrolling. In 2026, the best plan isn’t just about cost — it’s about how much support you can count on when you need it most.