Blue Cross vs Aetna out-of-pocket costs can be the difference between a plan that looks affordable on paper and one that actually fits your real-life medical needs. Premiums matter, sure—but what you pay when you visit the doctor, fill prescriptions, or land in the ER matters even more.

In this guide, we’ll break down Blue Cross vs Aetna out-of-pocket costs in a simple, human way so you can see which insurer is more likely to cost you less in 2026.

Who Are Blue Cross and Aetna?

🏥 Blue Cross Blue Shield

Blue Cross Blue Shield isn’t one single company—it’s a network of independent insurers that operate by state. That means Blue Cross vs Aetna out-of-pocket costs can vary depending on where you live and which local Blue Cross plan you’re on.

🏥 Aetna

Aetna is a nationwide insurer with more standardized plans across states. This can make Blue Cross vs Aetna out-of-pocket costs easier to compare if you move or travel often.

What Counts as Out-of-Pocket Costs?

When people compare Blue Cross vs Aetna out-of-pocket costs, they’re usually talking about:

-

Deductibles – What you pay before insurance starts paying

-

Copays – Flat fees for doctor visits or prescriptions

-

Coinsurance – Your percentage of the bill after deductible

-

Out-of-pocket maximum – Your yearly spending cap

These are the real-life costs that hit your wallet when you actually use your insurance.

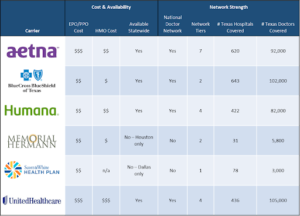

Blue Cross vs Aetna Out-of-Pocket Costs: Head-to-Head

| Cost Type | Blue Cross | Aetna |

|---|---|---|

| Deductibles | Often lower on HMO plans (varies by state) | More standardized across states |

| Copays | Lower for primary care in some regions | Competitive for specialist visits |

| Coinsurance | Moderate | Often slightly lower on PPO plans |

| Out-of-Pocket Max | Can be higher depending on state | Usually more predictable |

Key takeaway:

In many regions, Blue Cross vs Aetna out-of-pocket costs favor Blue Cross for routine primary care and favor Aetna for specialist-heavy care.

Real-Life Scenarios: Which Is Cheaper for You?

Blue Cross vs Aetna out-of-pocket costs play out differently depending on how you use healthcare:

-

If you mostly see a primary care doctor: Blue Cross may have lower copays.

-

If you see specialists often: Aetna may come out cheaper overall.

-

If you travel a lot: Aetna’s nationwide consistency can reduce surprise costs.

-

If you stay local: Blue Cross plans may offer lower out-of-pocket costs with strong local networks.

👉 You can compare real plan costs and networks using tools like https://quotemaestro.com/ to see which option is cheaper for your situation.

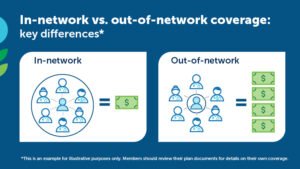

How Networks Affect Out-of-Pocket Costs

One of the biggest drivers of Blue Cross vs Aetna out-of-pocket costs is whether your doctors are in-network.

Out-of-network care can mean:

-

Higher deductibles

-

Higher coinsurance

-

Bills that don’t count toward your out-of-pocket maximum

Always check:

-

Your primary care doctor

-

Specialists

-

Hospitals

-

Prescription coverage

👉 You can compare real plan costs and networks using tools like https://quotemaestro.com/ to see which option is cheaper for your situation.

How to Lower Your Out-of-Pocket Costs (No Matter Who You Choose)

To reduce Blue Cross vs Aetna out-of-pocket costs, try these smart moves:

-

Choose in-network providers

-

Use telehealth for minor issues

-

Pick generic prescriptions

-

Compare HMO vs PPO plans

-

Estimate yearly usage before enrolling

These steps often save more money than chasing the lowest premium alone.

FAQs: Blue Cross vs Aetna Out-of-Pocket Costs

1. Which is cheaper overall for Blue Cross vs Aetna out-of-pocket costs?

There’s no universal winner. Blue Cross vs Aetna out-of-pocket costs depend on your state, plan type, and how often you use care.

2. Does Blue Cross or Aetna have lower deductibles?

In many regions, Blue Cross vs Aetna out-of-pocket costs show Blue Cross offering lower deductibles on HMO plans, while Aetna’s PPO deductibles are often more consistent.

3. Which has a lower out-of-pocket maximum?

Aetna frequently offers more predictable out-of-pocket maximums, but Blue Cross vs Aetna out-of-pocket costs can be lower in some states depending on the plan.

4. Are family plans more expensive out of pocket?

Yes. Family coverage increases Blue Cross vs Aetna out-of-pocket costs because deductibles and maximums are higher.

5. How can I find the cheapest plan in my area?

To accurately compare Blue Cross vs Aetna out-of-pocket costs, review plan brochures and use comparison platforms like https://quotemaestro.com/ to see real numbers for your location.