Blue Cross vs Aetna PPO vs HMO plans can seem confusing, but understanding how they differ is crucial for making a smart choice. Your plan affects premiums, out-of-pocket costs, and access to doctors, specialists, and hospitals.

This guide explains Blue Cross vs Aetna PPO vs HMO differences, helping you choose the right plan for 2026 based on your health needs, lifestyle, and budget.

Understanding PPO vs HMO Plans

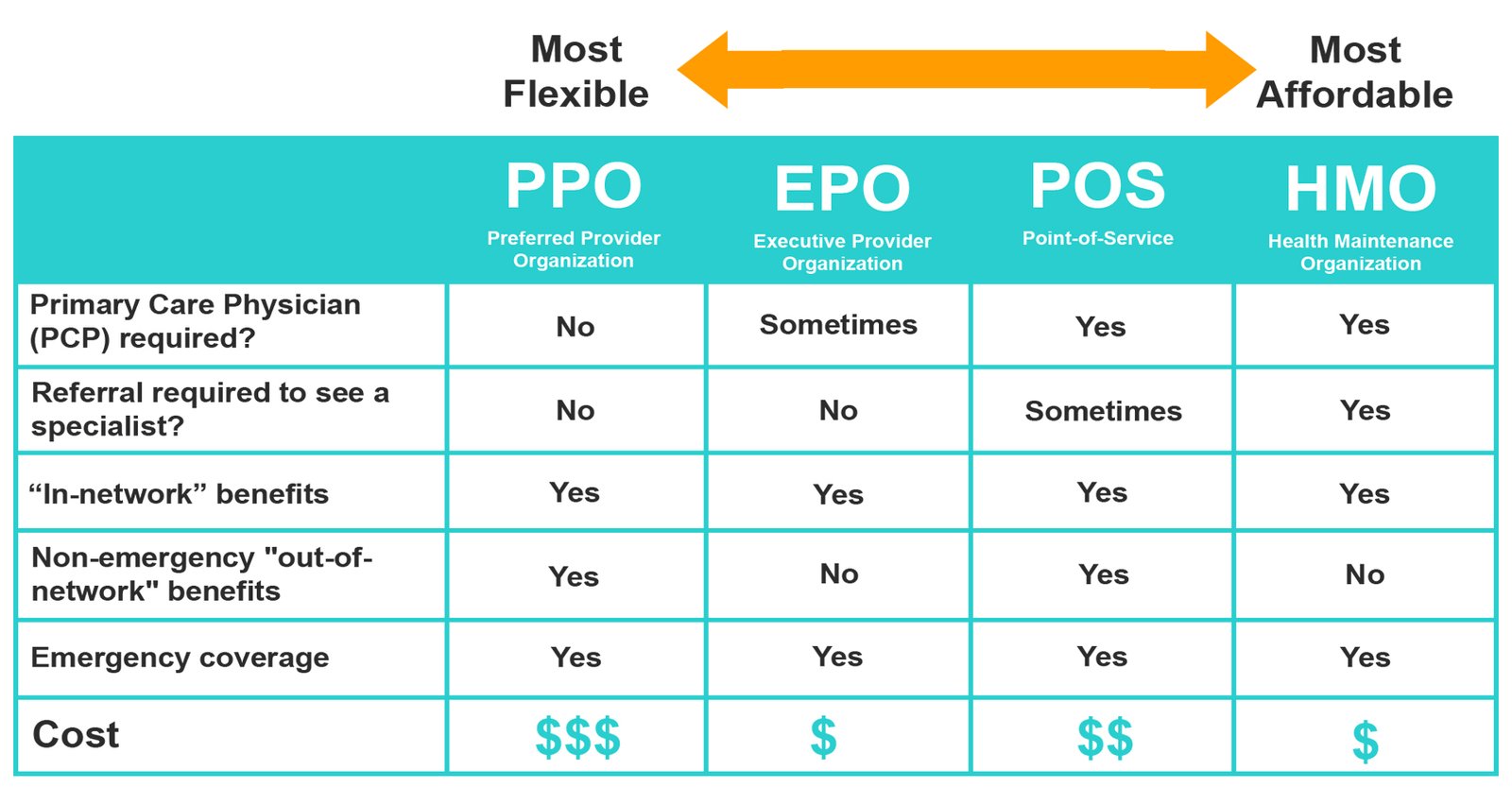

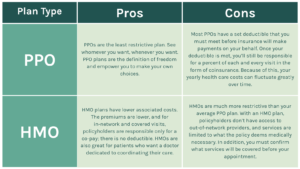

Before diving into Blue Cross vs Aetna PPO vs HMO, here’s a quick breakdown of plan types:

-

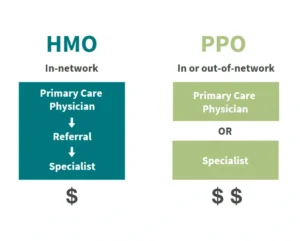

HMO (Health Maintenance Organization): Requires you to use in-network providers and get referrals for specialists. Typically lower premiums and out-of-pocket costs. Best for people who see the same local doctors regularly.

-

PPO (Preferred Provider Organization): Allows more flexibility to see out-of-network doctors without referrals. Premiums are higher, but you gain more freedom — ideal for travelers or those needing specialty care.

Understanding these plan types is the first step in comparing Blue Cross vs Aetna PPO vs HMO options.

Coverage Comparison: Blue Cross vs Aetna PPO vs HMO

| Coverage Aspect | Blue Cross | Aetna |

|---|---|---|

| Preventive Care | Covered 100% in-network | Covered 100% in-network |

| Specialist Visits | HMO requires referral; PPO flexible | HMO requires referral; PPO flexible |

| Prescription Drugs | Formulary varies by state | Nationwide consistent formulary |

| Chronic Condition Management | Covered; regional programs vary | Covered; standardized nationwide programs |

| Telehealth Access | Varies by state | Nationwide coverage for telehealth |

Real-world example: If you have diabetes, both Blue Cross and Aetna cover medications and checkups, but Aetna may offer standardized disease management programs nationwide, while Blue Cross programs vary by state.

Cost Comparison: Blue Cross vs Aetna PPO vs HMO

| Cost Factor | Blue Cross | Aetna |

|---|---|---|

| Monthly Premium | HMO lower, PPO higher | HMO lower, PPO higher |

| Deductibles | Moderate, varies by state | Predictable, consistent nationwide |

| Copays | Lower for primary care in HMO | Similar; PPO higher for specialists |

| Out-of-Pocket Max | Regional variation | Consistent across states |

Pro Tip: Estimate your yearly healthcare usage — if you visit specialists often or anticipate hospitalization, PPO plans might cost more but offer valuable flexibility. Use QuoteMaestro to compare Blue Cross vs Aetna PPO vs HMO costs for your area.

Network Comparison: Blue Cross vs Aetna PPO vs HMO

-

Blue Cross HMO plans: Strong local coverage, good for families who rarely travel.

-

Blue Cross PPO plans: Flexible and allows some out-of-network visits, but premiums are higher.

-

Aetna HMO plans: Consistent regional coverage and predictable network access.

-

Aetna PPO plans: Extensive nationwide network, excellent for frequent travelers or those seeing specialists outside their region.

Tip: Always confirm that your primary care doctor, preferred specialists, and nearby hospitals are in-network before enrolling in any Blue Cross vs Aetna PPO vs HMO plan.

Extra Tips for Choosing the Right Plan

-

Assess your healthcare usage: Frequent doctor visits or specialist care? PPO might save hassle.

-

Consider your location: Blue Cross coverage varies by state; Aetna plans are more consistent nationally.

-

Check for telehealth options: Both insurers offer telehealth, but Aetna has more nationwide access.

-

Estimate total costs: Don’t just look at premiums — consider deductibles, copays, and out-of-pocket maximums.

-

Look at family coverage: Some PPO plans are better for families who need flexible care across multiple locations.

-

Use comparison tools: Platforms like QuoteMaestro let you compare plans and costs quickly.

FAQs: Blue Cross vs Aetna PPO vs HMO

1. Which is better: Blue Cross or Aetna PPO?

PPO plans offer flexibility to see out-of-network providers. Blue Cross vs Aetna PPO vs HMO comparisons depend on premiums, network size, and travel habits.

2. Do HMO plans save money?

Yes. HMO plans under Blue Cross vs Aetna PPO vs HMO usually have lower premiums and out-of-pocket costs, but require referrals for specialists.

3. Can I see specialists without a referral?

Only under PPO plans. HMO plans require referrals for specialist visits in Blue Cross vs Aetna PPO vs HMO plans.

4. Which network is larger?

Aetna PPO plans generally have a larger nationwide network. Blue Cross PPO plans are flexible, but HMO networks are more regional.

5. How do I choose the best plan?

Compare costs, coverage, network access, and your healthcare needs. Tools like QuoteMaestro help you compare Blue Cross vs Aetna PPO vs HMO options in your area.

6. Are chronic condition programs different?

Yes. Blue Cross vs Aetna PPO vs HMO programs may vary by state. Aetna usually offers standardized nationwide chronic care management.

7. Does telehealth affect plan choice?

Telehealth availability can influence convenience. Aetna generally has more nationwide telehealth coverage compared to Blue Cross, which varies regionally.

Final Thoughts

When deciding between Blue Cross vs Aetna PPO vs HMO, consider your:

-

Healthcare needs — specialists, chronic conditions, or routine visits

-

Location and network — local vs nationwide coverage

-

Budget — premiums, deductibles, and out-of-pocket maximums

-

Flexibility — HMO vs PPO

HMO plans are cost-effective but less flexible. PPO plans provide freedom to see out-of-network providers at higher cost. Using tools like QuoteMaestro can help you compare Blue Cross vs Aetna PPO vs HMO plans and pick the best option for 2026.