How AI Is Changing Health Insurance Claims and Approvals

AI in Health Insurance is reshaping the entire industry as health insurance continues to evolve rapidly. From processing claims faster to improving accuracy in approvals, artificial intelligence is transforming how insurance agencies and companies operate. Whether you’re exploring Affordable Health Insurance Plans, managing home insurance, or checking auto insurance coverage, understanding how AI works in […]

Health Insurance 101: What Every First-Time Buyer Should Know

Health Insurance for First Time Buyers can feel overwhelming. With so many plans, premiums, deductibles, and coverage options, it’s easy to get lost. Whether you’re self-employed, comparing Affordable Health Insurance Plans, or reviewing options from an insurance agency, understanding the basics is the first step toward making smart decisions. This guide is designed to help […]

How to Choose Health Insurance as a Freelancer (Step-by-Step Guide)

How to Choose Health Insurance as a Freelancer (A step by step guide) How to Choose Health Insurance as a Freelancer can feel overwhelming, especially if you’re navigating insurance without employer support. Self-employed professionals don’t have the luxury of employer-sponsored insurance, which makes choosing the right health insurance plan critical. The right plan balances cost, […]

Tax Credits Freelancers Can Use to Lower Premiums

Health insurance can feel expensive when you’re freelancing or working for yourself, but Health Insurance Tax Credits can make a big difference. These credits are designed to help lower your monthly premiums and make your coverage more affordable. When you understand how these credits work, you can save hundreds or even thousands of dollars a […]

How to Estimate Your Annual Health Insurance Costs

Figuring out your yearly health insurance costs can feel tricky, especially when every plan has its own rules, prices, and coverage details. Breaking the numbers down step by step makes things easier, whether you’re comparing Affordable Health Insurance Plans, managing your budget, or working for yourself. The real goal is to understand what you’ll actually […]

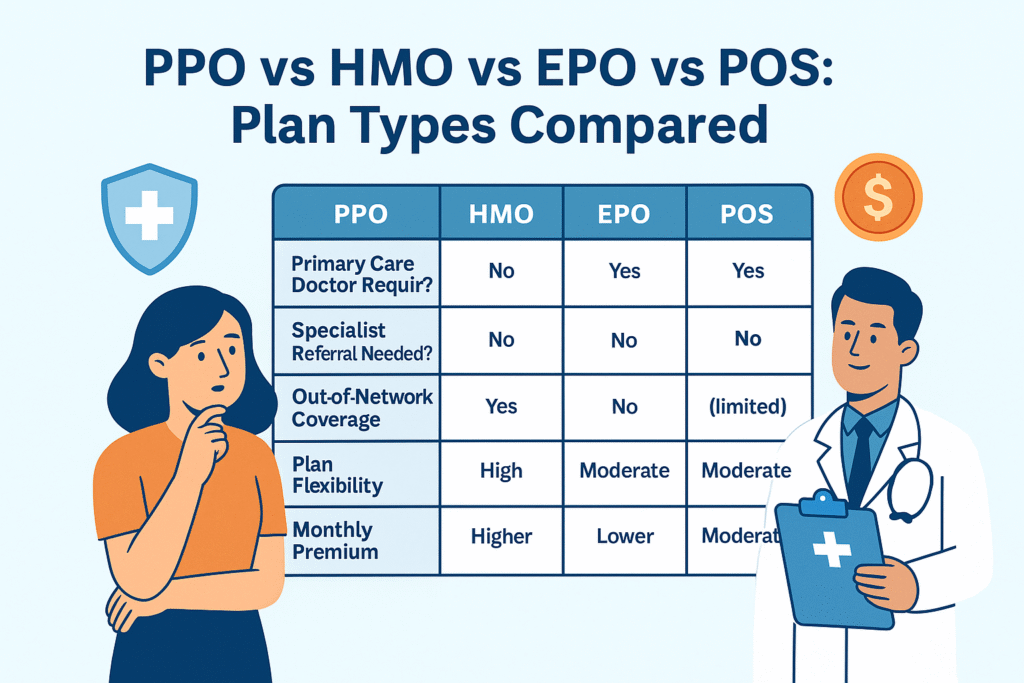

HMO vs PPO vs EPO: Clear Comparison for Freelancers

Choosing the right plan can be confusing, especially when comparing HMO vs PPO vs EPO: Clear Comparison for Freelancers. Each works differently, and the right choice depends on your healthcare needs, flexibility, and budget. What Is an HMO? — Best for Budget-Focused Freelancers An HMO (Health Maintenance Organization) is often the most affordable insurance type […]

Best Health Insurance Companies for Freelancers (2025 Guide)

Best Health Insurance Companies for Freelancers (2025 Guide) Freelancers need reliable and affordable health insurance without the support of an employer plan, and choosing the right provider can make a big difference in cost, coverage, and peace of mind. This guide highlights the best health insurance companies for freelancers in 2025, based on network size, […]