Comparing coverage options can be confusing, but when you compare insurance plans side-by-side, the differences become much clearer. This approach allows you to evaluate costs, coverage, and benefits at the same time, helping you avoid surprises and choose a plan that fits both your healthcare needs and financial goals.

Instead of reviewing plans one by one, a side-by-side comparison helps you quickly identify which plan offers better value, stronger coverage, and fewer hidden costs over the long term.

Compare Monthly Premiums Side-by-Side

Monthly premiums are the amount you pay to keep your insurance active. When you compare insurance plans side-by-side, don’t focus only on the lowest premium. A cheaper plan may come with higher deductibles or out-of-pocket costs later.

Side-by-side premium comparison helps you:

-

Understand how much you’ll pay annually

-

Balance affordability with coverage

-

Avoid plans that seem cheap upfront but cost more overall

Always consider premiums alongside other plan costs.

Comparing plans annually is no longer optional—it’s essential. Platforms like

Compare Deductibles When Reviewing Plans Side-by-Side

Deductibles determine how much you must pay before your insurance begins covering services. When you compare insurance plans side-by-side, deductible differences become easier to spot and evaluate.

Key points to review:

-

Individual vs. family deductibles

-

In-network and out-of-network deductibles

-

Prescription drug deductible requirements

If you expect regular medical care, a lower deductible plan may be the better option—even if the premium is higher.

Comparing plans annually is no longer optional—it’s essential. Platforms like

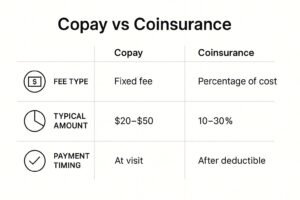

Compare Copays and Coinsurance Side-by-Side

Copays and coinsurance directly affect how much you pay each time you visit a doctor or fill a prescription. When you compare insurance plans side-by-side, these small numbers can reveal major cost differences over the year.

Be sure to compare:

-

Primary care copays

-

Specialist visit costs

-

Emergency room charges

-

Coinsurance percentages after the deductible

Side-by-side comparison helps estimate real-world healthcare expenses more accurately.

Comparing plans annually is no longer optional—it’s essential. Platforms like

Compare Out-of-Pocket Maximums Side-by-Side

The out-of-pocket maximum is the most you’ll pay in a year for covered services. When you compare insurance plans side-by-side, this number shows which plan offers better financial protection in worst-case scenarios.

Plans with lower out-of-pocket maximums may provide peace of mind, especially if unexpected medical emergencies arise.

Comparing plans annually is no longer optional—it’s essential. Platforms like

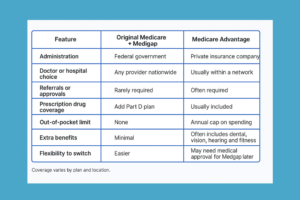

Compare Provider Networks Side-by-Side

Not all insurance plans include the same doctors, hospitals, or specialists. When you compare insurance plans side-by-side, checking provider networks ensures continuity of care.

Important network considerations include:

-

Whether your current doctors are in-network

-

Hospital access near your location

-

Referral requirements for specialists

Out-of-network care can significantly increase costs, making this step critical.

Comparing plans annually is no longer optional—it’s essential. Platforms like

Compare Prescription Drug Coverage Side-by-Side

Prescription coverage can vary widely between plans. When you compare insurance plans side-by-side, reviewing formularies and drug tiers helps prevent unexpected medication costs.

Look closely at:

-

Whether your medications are covered

-

Generic vs. brand-name drug tiers

-

Copays or coinsurance for prescriptions

-

Mail-order pharmacy options

This is especially important for individuals managing chronic conditions.

Comparing plans annually is no longer optional—it’s essential. Platforms like

Compare Extra Benefits and Coverage Side-by-Side

Many insurance plans include additional benefits beyond standard medical coverage. When you compare insurance plans side-by-side, these extras can add real value.

Common benefits to compare include:

-

Preventive care services

-

Telehealth and virtual visits

-

Mental health coverage

-

Wellness programs

-

Dental or vision add-ons

Extra benefits can improve convenience while reducing long-term costs.

Comparing plans annually is no longer optional—it’s essential. Platforms like

Side-by-Side Insurance Plan Comparison Checklist

Use this checklist to compare insurance plans side-by-side efficiently:

-

Monthly premiums

-

Deductibles

-

Copays and coinsurance

-

Out-of-pocket maximums

-

Provider networks

-

Prescription drug coverage

-

Extra benefits

Having everything listed together simplifies decision-making.

Common Mistakes When You Compare Insurance Plans Side-by-Side

Avoid these common errors when comparing plans:

-

Choosing a plan based only on premium

-

Ignoring out-of-pocket maximums

-

Overlooking provider network restrictions

-

Forgetting to review prescription coverage

Comparing insurance plans side-by-side helps prevent these costly mistakes.

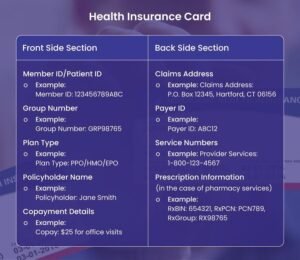

FAQs – How to Compare Insurance Plans Side-by-Side

What does it mean to compare insurance plans side-by-side?

It means reviewing multiple insurance plans at the same time to compare costs, coverage, and benefits in one clear view.

Why should I compare insurance plans side-by-side instead of individually?

Comparing insurance plans side-by-side highlights differences more clearly and reduces the risk of choosing a plan that doesn’t meet your needs.

How many insurance plans should I compare side-by-side?

Comparing three to five plans is ideal. It provides enough options without causing information overload.

Can families compare insurance plans side-by-side?

Yes. Families should compare insurance plans side-by-side with special attention to family deductibles, pediatric care, and provider access.

Does comparing insurance plans side-by-side help save money?

Yes. Many people find lower-cost plans with similar benefits when they compare insurance plans side-by-side.

Is side-by-side comparison useful for healthy individuals?

Absolutely. Even healthy individuals benefit from understanding worst-case costs and emergency coverage.

Final Thoughts on How to Compare Insurance Plans Side-by-Side

Learning how to compare insurance plans side-by-side gives you full control over your healthcare decisions. By reviewing premiums, deductibles, networks, and benefits together, you can confidently choose a plan that balances cost, coverage, and peace of mind—both now and in the future.

Comparing plans annually is no longer optional—it’s essential. Platforms like