Many people assume health insurance is only available during a short enrollment window. That leads to a common question: can you get health insurance anytime during the year?

The short answer is sometimes. While most people must enroll during Open Enrollment, there are specific situations where coverage is available year-round. Understanding can you get health insurance anytime during the year depends on your life circumstances, income, and the type of plan you’re considering.

This guide explains when you can enroll, when you can’t, and what options are available if you miss Open Enrollment—so you’re never left wondering can you get health insurance anytime during the year or what to do next.

What Is Open Enrollment for Health Insurance?

Open Enrollment is the annual period when most people can sign up for or change a health insurance plan without restrictions. For those asking can you get health insurance anytime during the year, Open Enrollment is the primary window when coverage is guaranteed.

During Open Enrollment, you can:

-

Enroll in a new health insurance plan

-

Switch existing plans

-

Change coverage levels

Outside this period, enrollment is limited unless you qualify for an exception—this is why understanding can you get health insurance anytime during the year is so important.

Can You Get Health Insurance Anytime During the Year?

In most cases, can you get health insurance anytime during the year? The answer is usually no—you cannot enroll outside Open Enrollment unless you qualify for a Special Enrollment Period or select a plan that allows year-round enrollment.

However, certain life events and plan types make it possible to get coverage outside Open Enrollment. These include losing job-based coverage, getting married, having a baby, moving to a new state, or qualifying for Medicaid or CHIP.

Comparing plans annually is no longer optional—it’s essential. Platforms like 👉 QuoteMaestro make it easy to see your options and determine whether you qualify to enroll at any time. Knowing can you get health insurance anytime during the year ensures you won’t miss opportunities for coverage and can protect yourself from unexpected medical costs.

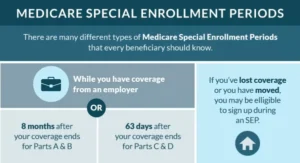

Special Enrollment Periods (SEPs) Explained

Many people wonder, can you get health insurance anytime during the year? The answer is: not always—but a Special Enrollment Period (SEP) allows you to enroll outside Open Enrollment if you experience a qualifying life event.

Common qualifying events include:

-

Losing job-based coverage

-

Marriage or divorce

-

Birth or adoption of a child

-

Moving to a new coverage area

-

Loss of Medicaid or CHIP eligibility

If you qualify, you typically have 60 days to enroll in a plan. This is one of the main ways people can get coverage outside the regular Open Enrollment window.

Losing Job-Based Coverage

If you lose employer-sponsored health insurance, you may qualify for a Special Enrollment Period.

This includes:

-

Job loss

-

Reduced work hours

-

Employer ending coverage

In these cases, you can get health insurance anytime during the year without waiting for Open Enrollment. Comparing plans annually is no longer optional—it’s essential. Platforms like 👉 QuoteMaestro make it easy to review your options and find the best coverage quickly.

Moving to a New State or Coverage Area

Relocating to a new state or ZIP code can qualify you for a Special Enrollment Period.

To be eligible:

-

The move must affect your available plans

-

You must have had prior qualifying coverage

This is one of the most common reasons people can get health insurance mid-year.

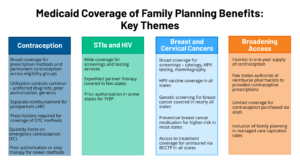

Medicaid and CHIP: Year-Round Enrollment

If your income meets eligibility requirements, Medicaid and CHIP allow enrollment at any time of the year.

There is no Open Enrollment requirement for these programs, making them accessible whenever you qualify.

Comparing plans annually is no longer optional—it’s essential. Platforms like

Short-Term Health Insurance Plans

Short-term health insurance plans can often be purchased year-round.

These plans:

-

Offer temporary coverage

-

Have lower premiums

-

Do not cover all ACA-required benefits

They may work as a temporary solution but are not ideal for long-term coverage.

Comparing plans annually is no longer optional—it’s essential. Platforms like

Employer-Sponsored Health Insurance

Employer health plans usually follow their own enrollment timelines.

You may be able to enroll:

-

When starting a new job

-

During employer open enrollment

-

After qualifying life events

Employer plans often have different rules than marketplace plans.

Comparing plans annually is no longer optional—it’s essential. Platforms like

What Happens If You Miss Open Enrollment?

If you miss Open Enrollment and don’t qualify for a Special Enrollment Period, your options may be limited.

You may need to:

-

Wait until the next Open Enrollment

-

Explore short-term plans

-

Check Medicaid or CHIP eligibility

Understanding your options helps avoid gaps in coverage.

Comparing plans annually is no longer optional—it’s essential. Platforms like

How to Know If You Qualify to Enroll Now

To determine if you can get health insurance anytime during the year, consider:

-

Recent life changes

-

Loss of existing coverage

-

Income changes

-

Location changes

Comparing plans and eligibility regularly can help you avoid missing opportunities.

Comparing plans annually is no longer optional—it’s essential. Platforms like

FAQs: Can You Get Health Insurance Anytime During the Year?

Can you get health insurance anytime during the year?

Not usually. Most people must enroll during Open Enrollment unless they qualify for a Special Enrollment Period or certain year-round plans.

What qualifies as a Special Enrollment Period?

Qualifying events include marriage, job loss, moving, having a baby, or losing existing coverage.

Can I get health insurance if I lose my job?

Yes. Losing job-based coverage typically qualifies you for a Special Enrollment Period.

Is Medicaid available year-round?

Yes. Medicaid and CHIP allow enrollment anytime if you meet eligibility requirements.

Are short-term health insurance plans available year-round?

In many states, yes—but they offer limited coverage and are not ACA-compliant.

Final Thoughts

So, can you get health insurance anytime during the year? The answer depends on your situation. While Open Enrollment is the main window, Special Enrollment Periods, Medicaid, and certain plans provide access to coverage throughout the year.

Understanding your eligibility and acting quickly after life changes can help you stay insured and avoid costly gaps in coverage.

Comparing plans annually is no longer optional—it’s essential. Platforms like