Understanding health insurance copays vs coinsurance is key to avoiding surprise medical bills. Most people focus on premiums but overlook how health insurance copays vs coinsurance actually affects what they pay at the doctor, hospital, or pharmacy.

Health Insurance Copays vs Coinsurance: What Copays Really Mean

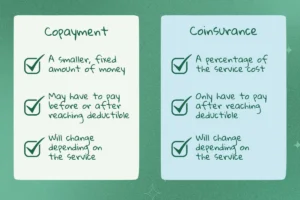

When comparing health insurance copays vs coinsurance, copays are the simpler, predictable option. A copay is a flat fee you pay each time you access care.

Examples of health insurance copays vs coinsurance with copays:

-

$25 for a primary care visit

-

$50 for a specialist

-

$10–$30 for prescriptions

Copays make budgeting easier, which is why many prefer copay-heavy plans when thinking about health insurance copays vs coinsurance.

Health Insurance Copays vs Coinsurance: What Coinsurance Really Means

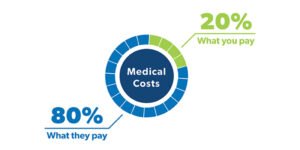

The trickier side of health insurance copays vs coinsurance is coinsurance. Coinsurance is a percentage of the total bill, which means your costs increase as the service cost rises.

Examples of health insurance copays vs coinsurance with coinsurance:

-

20% of a lab test

-

30% of an MRI

-

40% of an ER visit

This is why health insurance copays vs coinsurance can feel unpredictable for larger procedures.

Health Insurance Copays vs Coinsurance: Real-Life Cost Examples

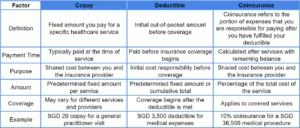

Here’s how health insurance copays vs coinsurance impacts your wallet in practice:

| Service | Copay Plan | Coinsurance Plan |

|---|---|---|

| Doctor Visit | $30 | 20% of $200 = $40 |

| MRI Scan | $75 | 20% of $2,000 = $400 |

| ER Visit | $150 | 20% of $5,000 = $1,000 |

These examples highlight how health insurance copays vs coinsurance can dramatically affect your out-of-pocket expenses.

Compare real plans and project your yearly costs using tools like 👉 Quote Maestro to see exactly how health insurance copays vs coinsurance will affect you.

Health Insurance Copays vs Coinsurance: Which One Costs Less?

When analyzing health insurance copays vs coinsurance, the cheapest option depends on your healthcare usage:

-

Frequent visits → health insurance copays vs coinsurance favors copays

-

Rare visits → health insurance copays vs coinsurance might favor coinsurance

-

Large medical bills → health insurance copays vs coinsurance favors lower coinsurance + lower out-of-pocket max

Compare real plans and project your yearly costs using tools like 👉 Quote Maestro to see exactly how health insurance copays vs coinsurance will affect you.

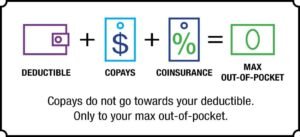

Health Insurance Copays vs Coinsurance: How Deductibles Affect Costs

Deductibles can complicate health insurance copays vs coinsurance. Many plans make you pay full price until the deductible is met:

-

Copays may not apply until after the deductible

-

Coinsurance applies only after deductible

Understanding this is crucial when evaluating health insurance copays vs coinsurance.

Health Insurance Copays vs Coinsurance: How to Choose the Right Plan

To minimize surprises with health insurance copays vs coinsurance, ask yourself:

-

Do I want predictable bills?

-

How often do I see doctors or specialists?

-

Can I handle a large unexpected bill?

Compare real plans and project your yearly costs using tools like 👉 Quote Maestro to see exactly how health insurance copays vs coinsurance will affect you.

Health Insurance Copays vs Coinsurance: FAQs

Health Insurance Copays vs Coinsurance: Doctor Visits

For routine visits, health insurance copays vs coinsurance usually favors copays because costs are predictable.

Health Insurance Copays vs Coinsurance: Hospital Stays

For major procedures, health insurance copays vs coinsurance favors low coinsurance to avoid large bills.

Health Insurance Copays vs Coinsurance: Early in the Year

At the start of the year, health insurance copays vs coinsurance can feel higher because deductibles haven’t been met.

Health Insurance Copays vs Coinsurance: Low-Premium Plans

Low-premium plans often rely heavily on coinsurance, making health insurance copays vs coinsurance riskier for frequent care.

Health Insurance Copays vs Coinsurance: Estimating Total Costs

Use plan summaries and tools like Quote Maestro to estimate yearly costs and understand health insurance copays vs coinsurance before enrolling.

Final Thoughts

Health insurance copays vs coinsurance determines whether your plan stays cheap or becomes expensive in real life.

-

Predictable costs? Copays usually win

-

Rare care and willing to take risks? Coinsurance may work, but be ready for large bills