Health Insurance for First Time Buyers can feel overwhelming. With so many plans, premiums, deductibles, and coverage options, it’s easy to get lost. Whether you’re self-employed, comparing Affordable Health Insurance Plans, or reviewing options from an insurance agency, understanding the basics is the first step toward making smart decisions. This guide is designed to help Health Insurance for First Time Buyers navigate the process with confidence and clarity.

Understand Your Health Insurance Options

Not all health insurance plans are the same. If you’re exploring Health Insurance for First Time Buyers, it’s important to understand the key types:

-

HMO (Health Maintenance Organization): Requires you to use a specific network of doctors; lower costs but limited flexibility.

-

PPO (Preferred Provider Organization): Offers more flexibility with providers; premiums are typically higher.

-

EPO (Exclusive Provider Organization): A hybrid of HMO and PPO; coverage is usually limited to in-network providers only.

-

High-Deductible Health Plans (HDHPs): Lower monthly premiums but higher out-of-pocket costs; often paired with Health Savings Accounts (HSAs).

Explore available options at QuoteMaestro

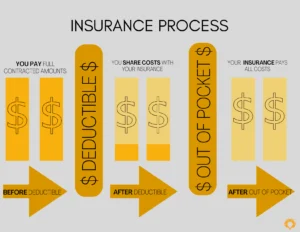

Know Your Premiums, Deductibles, and Out-of-Pocket Costs

When exploring Health Insurance for First Time Buyers, it’s important to look beyond just the monthly premium. Understanding how each cost works will help you choose a plan that fits both your health needs and your budget.

Premiums: The monthly cost of your plan

Deductibles: The amount you pay before your insurance starts covering expenses

Copays and Coinsurance: What you pay for doctor visits, prescriptions, tests, or procedures

Out-of-Pocket Maximum: The highest amount you’ll pay in a year for covered services

Knowing these numbers makes it easier for first-time buyers to find the best balance between cost, coverage, and long-term protection.

Check the Provider Network

Before enrolling, ensure your preferred doctors and hospitals are in the plan’s network. Health Insurance for First Time Buyers often requires extra attention here because many new buyers overlook this step, which can lead to unexpected costs later. This is equally important when comparing car insurance online, home insurance coverage, or any other type of insurance—always check what’s included.

Review Coverage Details Carefully

Health insurance covers more than doctor visits. Make sure you understand what’s included:

Preventive care such as vaccines and screenings

Prescription drugs

Mental health and therapy coverage

Emergency services

Knowing these details upfront helps you avoid surprises later.

You may also like [ How to Choose Health Insurance as a Freelancer ]

Consider Special Plans for Self-Employed or Young Adults

If you’re self-employed, freelance, or under 30, you might qualify for Affordable Health Insurance Plans tailored to your needs. These often have lower premiums or flexible deductibles while still providing essential coverage. Compare specialized plans at QuoteMaestro

Look for Discounts and Wellness Incentives

Some plans reward healthy living. Insurers may provide discounts for:

Regular preventive care

Participation in wellness programs

Healthy lifestyle habits

These Health Insurance for First-Time Buyers benefits can help lower your overall costs.

Use Comparison Tools to Make a Smart Choice

The easiest way to find the right plan is to compare options side by side. Look at premiums, deductibles, copays, network coverage, and special incentives. This approach works for health insurance, auto insurance, home insurance, or life insurance. Start comparing plans at QuoteMaestro

What First-Time Buyers Should Remember

Health insurance can feel complicated at first, but by taking it step by step, you can make informed decisions.

Know the types of plans available

Understand premiums, deductibles, and out-of-pocket costs

Check your provider network

Review coverage details carefully

Consider specialized plans for self-employed or young adults

Explore discounts and wellness incentives

Use comparison tools to pick the best plan

Compare all types of insurance easily at QuoteMaestro

You may also like [ HMO vs PPO vs EPO: Clear Comparison for Freelancers]

FAQS

1. What is the best type of health insurance for first-time buyers?

It depends on your needs. HMOs are cheaper but less flexible, PPOs offer more provider choice, and HDHPs can work well with Health Savings Accounts. Compare plans to find the best fit.

2. How do deductibles and copays affect costs for first-time buyers?

Deductibles are the amount you pay before insurance coverage starts, and copays are fixed amounts for services. Both affect your overall annual cost, so consider them when comparing plans.

3. Are there affordable health insurance options for self-employed first-time buyers?

Yes. Many insurers offer specialized plans with lower premiums or flexible deductibles designed for self-employed or freelance workers.

4. Can healthy living reduce insurance costs for first-time buyers?

Yes. Some plans offer discounts or incentives for preventive care, regular checkups, and healthy lifestyle habits.

5. Where can I compare health insurance plans as a first-time buyer?

You can compare all health insurance options, including affordable plans and specialized coverage, at QuoteMaestro

6. What coverage should first-time buyers focus on?

Focus on preventive care, prescription drugs, emergency services, and mental health coverage. Make sure your provider network includes your preferred doctors.