Losing a job can be stressful enough without worrying about losing your health coverage. Understanding your health insurance options after losing a job ensures that you and your family remain protected against unexpected medical costs.

Whether you’re considering COBRA, marketplace plans, Medicaid, or short-term coverage, knowing your health insurance options after losing a job can save you thousands and prevent coverage gaps.

Why You Need Coverage After Job Loss

Even if you rarely visit a doctor, medical emergencies can happen at any time. Exploring your health insurance options after losing a job protects you from high costs for:

-

Emergency room visits

-

Hospitalization or surgeries

-

Prescription medications

-

Preventive care services

Without coverage, even minor medical issues can become financially overwhelming.

COBRA: Keeping Your Employer Coverage

COBRA (Consolidated Omnibus Budget Reconciliation Act) lets you temporarily keep your employer-sponsored health insurance.

Key points about COBRA:

-

Usually lasts 18 months (sometimes longer)

-

You pay full premiums plus a small administrative fee

-

Provides identical coverage to your former job

COBRA is one of the most reliable health insurance options after losing a job, especially if you want to maintain the same provider network and benefits.

Marketplace Health Insurance Plans

Losing a job qualifies you for a Special Enrollment Period, allowing you to enroll in a marketplace plan.

Benefits include:

-

Variety of coverage levels (Bronze, Silver, Gold, Platinum)

-

Potential premium subsidies based on income

-

Access to preventive care and essential benefits

Comparing plans annually is no longer optional—it’s essential. Platforms like 👉 QuoteMaestro make it simple to review options and select the best health insurance options after losing a job.

Medicaid: Year-Round Coverage

If your income drops after losing a job, you may qualify for Medicaid, which allows enrollment anytime.

Advantages:

-

Low or no monthly premiums

-

Covers essential services

-

Year-round enrollment

Medicaid remains a critical safety net for those exploring health insurance options after losing a job.

Short-Term Health Insurance

Short-term or temporary health insurance can be purchased year-round.

-

Provides basic protection against major emergencies

-

Usually has lower premiums than traditional plans

-

May not cover all ACA-required benefits

Short-term plans are a stopgap solution, ideal if you expect to secure permanent coverage soon.

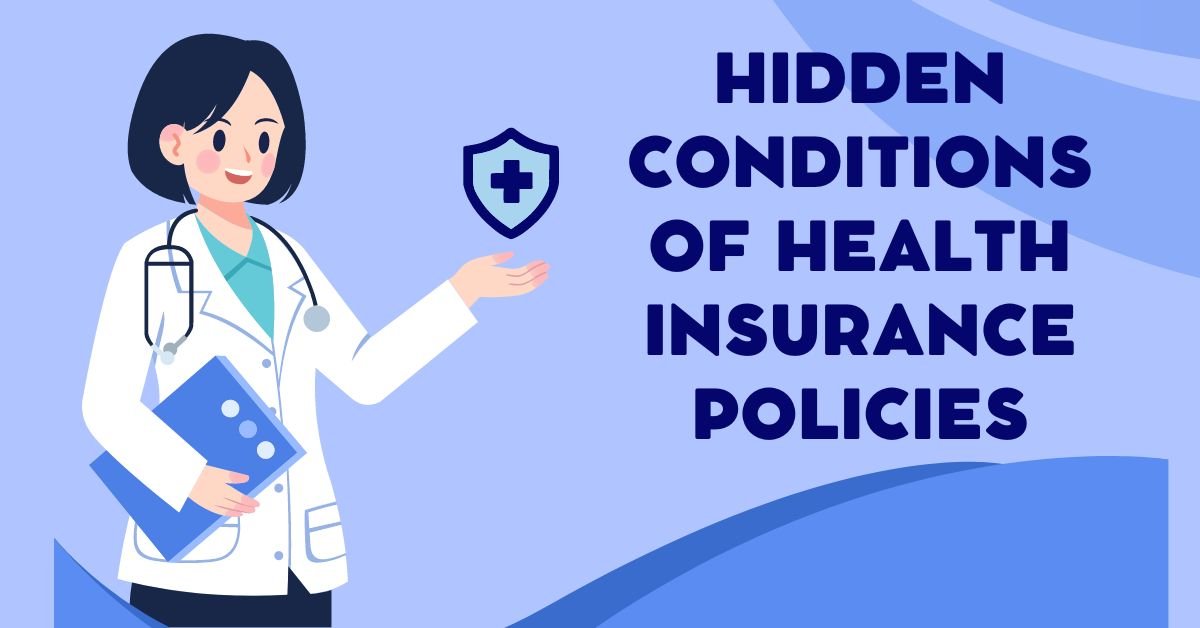

Health Savings Accounts (HSAs) and HDHPs

Pairing a high-deductible health plan (HDHP) with a Health Savings Account (HSA) is another smart option after losing a job:

-

HDHPs have lower premiums

-

HSAs allow tax-free contributions and withdrawals for medical expenses

-

Flexible for individuals with minimal routine care needs

This combination is often one of the most cost-effective health insurance options after losing a job for healthy adults.

How to Choose the Right Option

When evaluating your choices:

-

Compare monthly premiums and deductibles

-

Check provider network coverage

-

Consider short-term vs long-term needs

-

Factor in prescription medications and preventive care

Balancing these factors ensures you find the health insurance option after losing a job that fits your needs and budget.

FAQs: Health Insurance Options After Losing a Job

What are the main health insurance options after losing a job?

COBRA, marketplace plans, Medicaid, short-term plans, and HDHP + HSA are the most common health insurance options after losing a job.

How long do I have to enroll in a plan after losing my job?

Most Special Enrollment Periods give you 60 days to sign up for coverage after losing a job.

Can I keep my employer plan after leaving?

Yes. Through COBRA, you can temporarily keep your employer coverage by paying the full premium.

Is Medicaid available if my income drops?

Yes. Medicaid allows year-round enrollment if you meet income eligibility.

Can I compare plans online after losing a job?

Absolutely. Platforms like 👉 QuoteMaestro make it easy to review and compare health insurance options after losing a job.