Hidden health insurance costs are the sneaky expenses nobody warns you about when you sign up for a plan. You see the monthly premium and think, “Cool, I can afford this.” Then life happens—and suddenly you’re staring at bills you didn’t expect.

Let’s break down the most common hidden health insurance costs in plain, human language so you can avoid nasty financial surprises.

1. Deductibles That Reset Every Year

One of the biggest hidden health insurance costs is that your deductible resets annually. Even if you just met it in December, you’re back to $0 in January.

Why it hurts:

You can end up paying thousands again just because the calendar flipped.

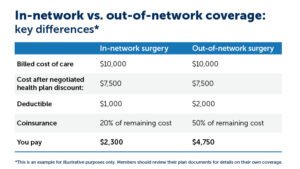

2. Out-of-Network Charges

You might go to an in-network hospital but get treated by an out-of-network doctor (like an anesthesiologist). Yep—this is one of the most frustrating hidden health insurance costs.

Tip: Always ask if everyone involved in your care is in-network.

If you’re comparing real plans and want to see true costs (not just premiums), tools like https://quotemaestro.com/ can help you spot hidden health insurance costs before you commit.

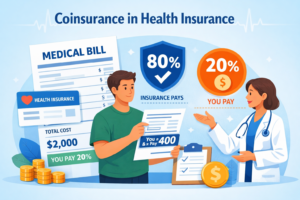

3. Coinsurance (The Bill You Didn’t Expect)

After your deductible, you may still owe 20–40% of the bill. Coinsurance is one of those hidden health insurance costs that people forget about until a big bill shows up.

4. Prescription Drug Tiers

Not all prescriptions are priced the same. Brand-name meds, specialty drugs, and even some generics can come with high copays—another classic hidden health insurance costs trap.

5. Facility Fees

Hospitals and clinics often charge facility fees on top of doctor fees. These extra charges are quiet but real hidden health insurance costs that can double what you expected to pay.

6. Diagnostic Tests and Imaging

MRIs, CT scans, and lab work can cost way more than the visit itself. These tests are some of the most expensive hidden health insurance costs people overlook.

7. Emergency Room “Surprise” Bills

Even with coverage, ER visits often come with high copays and coinsurance. ER bills are one of the most painful hidden health insurance costs because you usually don’t get to shop around.

8. Out-of-Pocket Maximum Confusion

People assume once they hit their out-of-pocket max, everything is free. Not always. Some services may not count—yet another hidden health insurance costs surprise.

9. Non-Covered Services

Some treatments, therapies, or alternative care simply aren’t covered. These non-covered items are sneaky hidden health insurance costs that can drain your budget fast.

If you’re comparing real plans and want to see true costs (not just premiums), tools like https://quotemaestro.com/ can help you spot hidden health insurance costs before you commit.

How to Protect Yourself from Hidden Health Insurance Costs

You can’t avoid all hidden health insurance costs, but you can reduce them:

-

✅ Always confirm in-network providers

-

✅ Ask for cost estimates before procedures

-

✅ Use urgent care instead of ER when appropriate

-

✅ Review your drug formulary

-

✅ Compare plans carefully before enrolling

If you’re comparing real plans and want to see true costs (not just premiums), tools like https://quotemaestro.com/ can help you spot hidden health insurance costs before you commit.

FAQs: Hidden Health Insurance Costs

1. What are the most common hidden health insurance costs?

Deductibles, coinsurance, out-of-network fees, and prescription tiers are the most common hidden health insurance costs people overlook.

2. Why do hidden health insurance costs feel so unpredictable?

Because plans are full of fine print. Hidden health insurance costs often live in policy details people don’t read.

3. Can I avoid hidden health insurance costs completely?

No, but you can reduce hidden health insurance costs by choosing in-network providers and understanding your plan.

4. Are hidden health insurance costs worse with cheaper plans?

Often yes. Low-premium plans usually come with higher hidden health insurance costs when you use care.

5. How do I compare plans to avoid hidden health insurance costs?

Look beyond premiums. Compare deductibles, copays, coinsurance, and networks. You can also use https://quotemaestro.com/ to preview potential hidden health insurance costs.

Final Take

Hidden health insurance costs are real—and they’re the reason so many people feel blindsided by medical bills. The smartest move isn’t just picking the cheapest premium, but choosing the plan that matches how you actually use healthcare.