Missing Open Enrollment doesn’t have to leave you without health insurance. Understanding how to get coverage if you miss open enrollment ensures you can still protect yourself from unexpected medical expenses.

This guide explains your options, including Special Enrollment Periods (SEPs), Medicaid, short-term insurance, and strategies for securing coverage outside the standard enrollment window.

What Is Open Enrollment?

Open Enrollment is the yearly period when anyone can sign up for or change their health insurance plan without needing a special reason.

During Open Enrollment, you can:

-

Enroll in a new plan

-

Switch plans or coverage levels

-

Add or remove dependents

Outside this period, enrollment is limited unless you qualify for an exception.

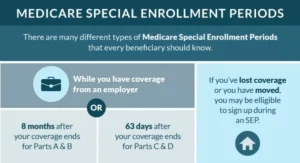

Special Enrollment Periods (SEPs)

If you miss Open Enrollment, a Special Enrollment Period (SEP) is the main way to get coverage. SEPs are triggered by life events, including:

-

Losing employer-sponsored insurance

-

Marriage or divorce

-

Birth or adoption of a child

-

Moving to a new state or coverage area

-

Losing Medicaid or CHIP eligibility

Most SEPs give you 60 days from the qualifying event to enroll in a new plan.

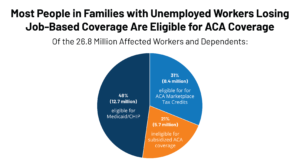

Losing Job-Based Health Coverage

Losing a job is a common reason for a Special Enrollment Period. If your employer ends coverage or you leave your job, you can still secure health insurance.

Options include:

-

COBRA continuation coverage

-

Marketplace plans through SEP

-

Medicaid (if eligible)

Comparing plans annually is no longer optional—it’s essential. Platforms like 👉 QuoteMaestro make it easy to review your options if you miss Open Enrollment.

Medicaid and CHIP

If your income qualifies, Medicaid and CHIP allow you to enroll at any time—even if Open Enrollment has ended.

Benefits:

-

Low or no monthly premiums

-

Essential health services

-

Year-round availability

These programs are a vital safety net for people who missed Open Enrollment.

Short-Term Health Insurance

Short-term or temporary health insurance is another option if you miss Open Enrollment.

-

Usually lower premiums than ACA-compliant plans

-

Provides coverage for major emergencies

-

Typically does not include all ACA-required benefits

Short-term plans are ideal as a temporary solution while you wait for the next Open Enrollment period.

Employer Health Plans Outside Open Enrollment

Some employers allow exceptions for mid-year enrollment after a qualifying life event, such as:

-

Marriage

-

Birth of a child

-

Loss of other coverage

If eligible, you can enroll in your employer’s health plan even if Open Enrollment is over.

How to Choose the Right Option

When deciding how to get coverage if you miss open enrollment, consider:

-

Monthly premiums vs. out-of-pocket costs

-

Coverage for prescriptions and preventive care

-

Provider network and hospital access

-

Temporary vs. long-term needs

Evaluating these factors ensures you select a plan that balances affordability with protection.

FAQs – How to Get Coverage If You Miss Open Enrollment

Can I get health insurance if I miss Open Enrollment?

Yes, through Special Enrollment Periods, Medicaid, CHIP, short-term plans, or certain employer exceptions.

What qualifies for a Special Enrollment Period?

Life events like losing job coverage, marriage, divorce, childbirth, or relocation can trigger a SEP.

How long do I have to enroll after a qualifying event?

Typically 60 days from the event to enroll in a new plan.

Is Medicaid available if I miss Open Enrollment?

Yes. Medicaid and CHIP allow year-round enrollment for eligible individuals.

Are short-term plans a good solution?

Short-term plans can provide temporary protection but may not cover all essential benefits.

Final Thoughts

Missing Open Enrollment doesn’t mean you have to go without health insurance. Understanding how to get coverage if you miss open enrollment—through Special Enrollment Periods, Medicaid, CHIP, short-term plans, or employer exceptions—ensures you remain protected.

Act quickly after qualifying events, compare your options, and select the plan that best fits your healthcare needs and budget.