Figuring out your yearly health insurance costs can feel tricky, especially when every plan has its own rules, prices, and coverage details. Breaking the numbers down step by step makes things easier, whether you’re comparing Affordable Health Insurance Plans, managing your budget, or working for yourself. The real goal is to understand what you’ll actually spend in a year, not just what you see in a brochure from an insurance agency or when browsing insurance company websites online.

Begin with your monthly premium

Your monthly premium is the part you can count on. Multiply that number by twelve to see what you’ll pay over the year. This applies to most plans, including options built for independent contractors or anyone searching for Affordable Health Insurance Plans.

Start comparing plans: https://quotemaestro.com

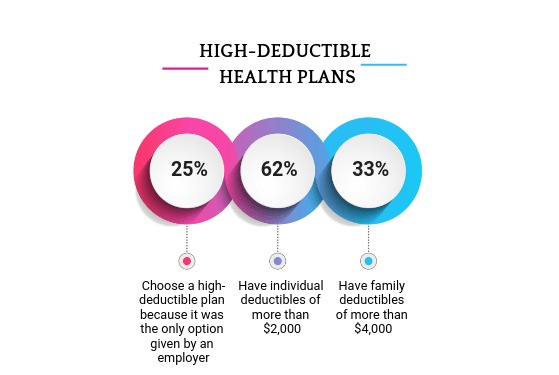

Understand your deductible

Your deductible is what you cover out of pocket before insurance steps in. Plans that look cheap upfront often have higher deductibles. This number makes a big difference, especially if you’re comparing low-cost plans, private insurance, or health insurance for freelancers.

Include coinsurance and copays

Every plan treats doctor visits, prescriptions, and urgent care a little differently. Coinsurance is a percentage of the bill after your deductible, while copays are fixed amounts. These costs add up fast if you need regular care, and this applies to all types of insurance services—not just health insurance.

Check your out-of-pocket maximum

This is the most you’ll spend in a year for covered services. After you reach it, your plan pays the rest. It works a lot like protection limits in home or auto insurance and gives you financial safety if you expect bigger medical needs.

Think about your health needs

Take a realistic look at the year ahead. Do you expect checkups, planned surgeries, or ongoing prescriptions? Your needs help you decide whether a lower premium or a lower deductible gives you better value. This same mindset helps when figuring out things like what home insurance covers or what to check in auto insurance.

Affordable Health Insurance Plans

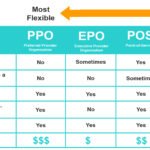

Compare plans side by side

Comparison tools make this part easier, whether you’re checking health, home, or auto insurance. When you can see premiums, deductibles, copays, and total yearly costs in one place, it’s much simpler to spot the best fit.

Think about your health needs

Take a realistic look at the year ahead. Do you expect checkups, planned surgeries, or ongoing prescriptions? Your needs help you decide whether a lower premium or a lower deductible gives you better value. This same mindset helps when figuring out things like what home insurance covers or what to check in auto insurance.

Affordable Health Insurance Plans

Compare plans side by side

Comparison tools make this part easier, whether you’re checking health, home, or auto insurance. When you can see premiums, deductibles, copays, and total yearly costs in one place, it’s much simpler to spot the best fit.

Think about your health needs

Take a realistic look at the year ahead. Do you expect checkups, planned surgeries, or ongoing prescriptions? Your needs help you decide whether a lower premium or a lower deductible gives you better value. This same mindset helps when figuring out things like what home insurance covers or what to check in auto insurance.When you’re evaluating Affordable Health Insurance Plans, it helps to use trustworthy resources that explain coverage rules clearly. One reliable place to double-check definitions, enrollment dates, and cost breakdowns is Healthcare.gov, the official government marketplace for health insurance: https://www.healthcare.gov.

Finding Affordable Health Insurance Plans

Compare plans side by side

Comparison tools make this part easier, whether you’re checking health, home, or auto insurance. When you can see premiums, deductibles, copays, and total yearly costs in one place, it’s much simpler to spot the best fit. At QuoteMaestro’s Website, you can use our website to look ast and compare health insurance and more!