Health insurance can feel confusing—especially when terms like deductibles, copays, and coinsurance start showing up on your plan documents. If you’re enrolled in Blue Cross Blue Shield or thinking about signing up, understanding how these costs work is essential to managing your healthcare budget.

This guide breaks down BCBS Health Insurance Deductibles Copays Coinsurance in simple terms so you know exactly what you’re paying for—and when.

Why These Costs Matter in BCBS Health Insurance

Even the best health insurance plans don’t cover 100% of medical costs right away. Deductibles, copays, and coinsurance determine how costs are shared between you and Blue Cross Blue Shield.

Understanding BCBS Health Insurance Deductibles Copays Coinsurance helps you:

-

Avoid surprise medical bills

-

Compare BCBS plans more accurately

-

Choose coverage that fits your healthcare needs

Comparing plans annually is no longer optional—it’s essential. Platforms like

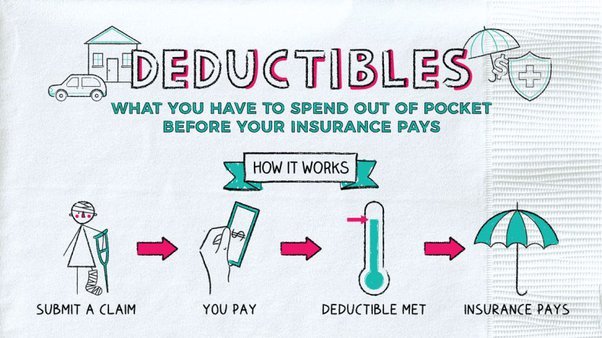

What Is a Deductible in BCBS Health Insurance?

A deductible is the amount you must pay out of pocket each year before your BCBS plan begins to cover certain services.

For example:

-

If your deductible is $1,500, you’ll pay the first $1,500 of covered medical expenses yourself.

-

After meeting the deductible, BCBS starts sharing costs with you.

Many BCBS plans cover preventive services—like annual checkups and screenings—before the deductible is met. This is an important part of how BCBS Health Insurance Deductibles Copays Coinsurance work together.

Comparing plans annually is no longer optional—it’s essential. Platforms like

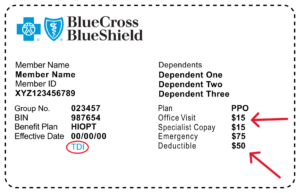

What Are Copays?

A copay is a fixed amount you pay for specific healthcare services.

Common examples include:

-

$25 for a primary care visit

-

$50 for a specialist visit

-

$10–$30 for prescription drugs

Copays usually apply even after you’ve met your deductible and provide predictable, easy-to-budget costs within BCBS Health Insurance Deductibles Copays Coinsurance structures.

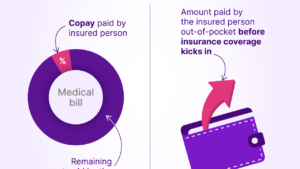

What Is Coinsurance?

Coinsurance is the percentage of costs you pay after meeting your deductible.

For example:

-

Your plan covers 80%

-

You pay 20% coinsurance

If a covered service costs $1,000, BCBS pays $800, and you pay $200. Coinsurance continues until you reach your annual out-of-pocket maximum—another key element of BCBS Health Insurance Deductibles Copays Coinsurance.

Comparing plans annually is no longer optional—it’s essential. Platforms like

How Deductibles, Copays, and Coinsurance Work Together

Here’s how BCBS Health Insurance Deductibles Copays Coinsurance typically interact in a BCBS plan:

-

You pay your deductible first

-

Copays apply for certain visits or prescriptions

-

Coinsurance applies to covered services after the deductible

-

Once you hit your out-of-pocket maximum, BCBS covers 100% of covered services

Understanding this flow is key to estimating your total healthcare costs.

Choosing the Right BCBS Plan Based on Cost Sharing

When comparing BCBS plans, always evaluate BCBS Health Insurance Deductibles Copays Coinsurance together—not separately.

Consider:

-

Higher deductible = lower monthly premium

-

Lower deductible = higher monthly premium

-

Copay-focused plans for frequent doctor visits

-

Coinsurance-heavy plans for major medical events

The right balance depends on how often you use healthcare and your financial comfort level.

Comparing plans annually is no longer optional—it’s essential. Platforms like

Frequently Asked Questions (FAQs)

Do BCBS plans always require a deductible?

Most plans do, but some services—like preventive care—are covered before the deductible.

Are copays included in the deductible?

Usually no. Copays are separate and don’t count toward your deductible, but they may count toward your out-of-pocket maximum.

What’s better: copays or coinsurance?

Copays are predictable, while coinsurance can vary. The better option depends on how often and what type of care you need.

Do BCBS plans have out-of-pocket maximums?

Yes. Once you reach this limit, BCBS pays 100% of covered services for the rest of the year.

Final Thoughts

Understanding BCBS Health Insurance Deductibles Copays Coinsurance puts you in control of your healthcare spending. These cost-sharing elements may seem complicated at first, but once you know how they work together, choosing the right Blue Cross Blue Shield plan becomes much easier.

A little knowledge now can save you a lot of money later.