When you need medical attention quickly, it’s important to know the difference between urgent care and the emergency room (ER) and understand what your insurance covers. Comparing urgent care vs ER insurance coverage helps you make smarter decisions and avoid unnecessary costs.

This guide breaks down the differences, typical insurance coverage, and tips for choosing the right care in various situations.

What Is Urgent Care?

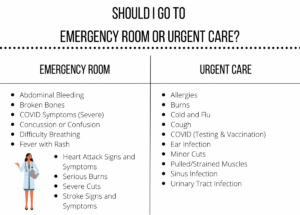

Urgent care centers handle non-life-threatening medical problems that need prompt attention.

Common urgent care services include:

-

Minor injuries (sprains, cuts, fractures)

-

Flu, cold, or fever

-

Minor infections

-

Lab tests or X-rays

Urgent care is usually cheaper than ER visits and often covered by most insurance plans with lower copays and coinsurance.

What Is an Emergency Room (ER)?

ERs are designed for serious or life-threatening conditions that require immediate attention.

ER services include:

-

Heart attacks or chest pain

-

Severe injuries or head trauma

-

Difficulty breathing or stroke symptoms

-

Severe allergic reactions

ER visits are typically more expensive than urgent care, and insurance coverage depends on your plan’s in-network rules and copays.

Urgent Care vs ER Insurance Coverage

Understanding insurance coverage is key when deciding between urgent care and ER:

| Feature | Urgent Care | ER |

|---|---|---|

| Typical Copay | Low ($20–$50) | Higher ($100+) |

| Coinsurance | Usually lower | Often higher |

| Deductible Applies | Yes | Yes |

| Coverage | Most plans cover | Most plans cover emergencies |

| Wait Time | Shorter | Longer |

Tip: Always check if the facility is in-network to reduce costs. You can use platforms like 👉 QuoteMaestro to compare insurance plans and see which cover urgent care vs ER visits most efficiently.

When to Choose Urgent Care vs ER

-

Go to urgent care for minor injuries, infections, or situations that need prompt care but aren’t life-threatening.

-

Go to the ER for serious, life-threatening emergencies or when in doubt about the severity.

Choosing the right setting can save time and money while ensuring proper care.

Cost Considerations

-

ER visits are significantly more expensive than urgent care.

-

Insurance coverage may require you to meet a deductible first.

-

Using urgent care for non-emergencies can help avoid high out-of-pocket costs.

Insurance Tips for Urgent Care and ER

-

Confirm if the facility is in-network.

-

Understand copays, coinsurance, and deductibles.

-

Keep a list of nearby urgent care centers and ERs.

-

Use plan comparison tools like 👉 QuoteMaestro to find plans with better coverage for urgent care and ER visits.

FAQs: Urgent Care vs ER Insurance Coverage

What’s the difference between urgent care and ER insurance coverage?

Urgent care is typically cheaper with lower copays and coinsurance, while ER visits are more expensive but necessary for life-threatening emergencies.

Does insurance cover urgent care visits?

Yes, most health insurance plans cover urgent care, but the cost may vary depending on network status and deductibles.

When should I go to the ER instead of urgent care?

For life-threatening conditions like heart attacks, strokes, severe injuries, or difficulty breathing.

Are urgent care visits cheaper than ER visits?

Yes. Urgent care typically costs significantly less than ER visits, especially for non-emergency care.

Can I compare insurance plans for urgent care vs ER coverage?

Absolutely. Platforms like 👉 QuoteMaestro allow you to compare plans and see coverage differences for urgent care and ER visits.

Final Thoughts

Knowing the difference between urgent care vs ER insurance coverage can save you money and ensure timely medical care. For non-life-threatening issues, urgent care is often the more cost-effective option, while the ER should be reserved for serious emergencies.

Always check your plan’s coverage, stay in-network, and use tools like 👉 QuoteMaestro to compare insurance plans that best meet your urgent care and ER needs.